- NZDUSD is in the green again today, a tad above a key level

- Bearish pressure lingers as NZDUSD traded at a 1-year low

- Momentum indicators could soon turn bullish

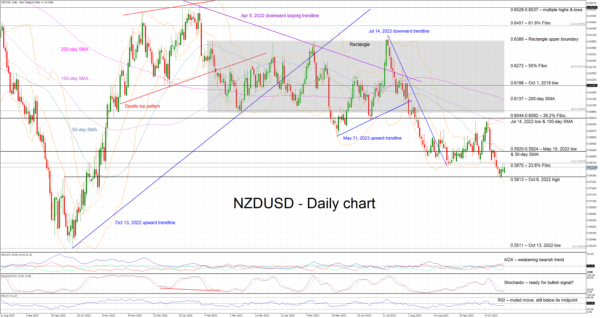

NZDUSD is edging higher today, recording its third consecutive green candle but trading only a tad above the key 0.5813 level. The bears remain in control of the market as the latest downleg, from the October 11 local peak, pushed NZDUSD to the lowest level since November 4, 2022.

Understandably, the focus is now on the momentum indicators for any indications for the next leg in NZDUSD. More specifically, the Average Directional Movement Index (ADX) points to a weakening bearish trend in the market, and the RSI remains a tad below its 50-midpoint. More importantly, the stochastic oscillator is trying to edge above its moving average and exit its oversold territory. Should this take place, the current muted upleg could gain significant traction.

If the bulls feel more confident, they could try to overcome the 23.6% Fibonacci retracement of the April 5, 2022 – October 13, 2022 downtrend at 0.5870, and then push NZDUSD towards the busier 0.5920-0.5924 region. This area is key for short-term sentiment and, if broken, it could open the door for a stronger move towards the 0.6044-0.6092 range.

On the flip side, the bears are probably taking a breather and are preparing for the next sell-off. The support set by the October 6, 2022 high at 0.5813 remains considerable, as proven last week. A successful break below this level would allow the bears to record a new 2023 low and then set sail for the October 13, 2022 low at 0.5511.

To sum up, NZDUSD bulls are trying to defend the 0.5813 level and stage a move towards 0.5920, but they need strong support from the momentum indicators to fend off the bears.