- Gold extends rebound, tries to overtake 100-period SMA

- But risk that rally is becoming overstretched

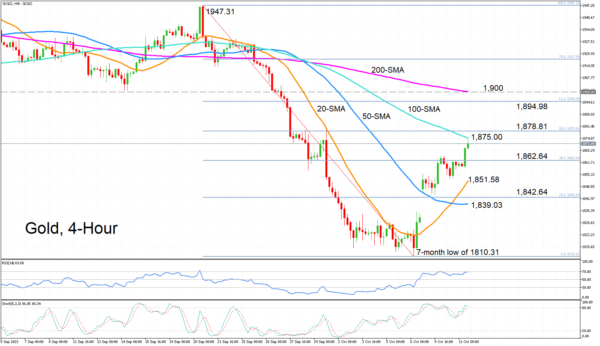

Gold climbed to a near two-week high on Wednesday, briefly hitting 1,874.65, as the rebound from the seven-month low of 1,810.31 continued to gain traction. The momentum indicators point to an ongoing positive bias in the short term, but there is a risk the recovery could soon run out of breath.

The RSI is crossing into the overbought region above 70 and the stochastics are rising inside their respective overbought area. This may be a sign that a downside correction could be nearing.

For the bulls to maintain their upward charge, they would first have to tackle the 100-period simple moving average (SMA) at 1,875.00 in the 4-hour chart. They could also run into trouble at the 50% Fibonacci retracement of the September-October downleg at 1,878.81. Successfully clearing these hurdles would pave the way for the 61.8% Fibonacci of 1,894.98 as well as the 200-period SMA just above the crucial 1,900 level.

However, should the rebound falter, there could be immediate support at the 38.2% Fibonacci of 1,862.64 followed by the 20-period SMA at 1,851.58. If broken, the precious metal could next seek support from the 23.6% Fibonacci of 1,842.64, which is located not too far away from the 50-period SMA at 1,839.03. An even bigger selloff would put gold on path to retest the October low of 1,810.31.

In brief, despite the rising risk of the rally running out of steam soon, the short-term prospects are looking increasingly bullish. Reclaiming the 100-period SMA would reinforce the uptrend whereas a drop below the 50-period SMA would threaten to shift the short-term picture back to negative.