- NZDUSD trades sideways amidst geopolitical developments

- The current short-term upleg started when NZDUSD failed to break 0.5870

- Momentum indicators are somewhat supportive of the current move

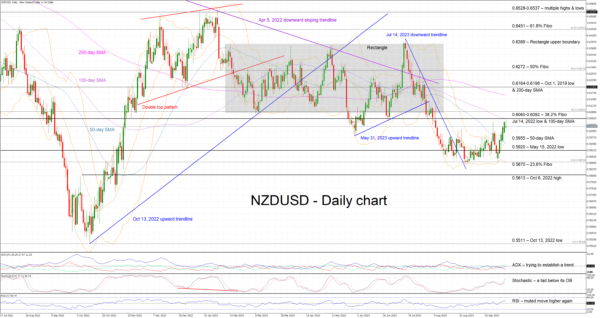

NZDUSD is trading sideways today after registering five strong green candles. It tested the 0.5870 level multiple times during September, but it failed to break it thus fuelling the current short-term rally. It has now reached a key resistance area, a tad below the lower boundary of the February-August rectangle.

Understandably, the focus is now on the momentum indicators and their likely support for the current move. More specifically, the Average Directional Movement Index (ADX) points to a weak bullish trend in the market, and the RSI remains a tad above its 50-midpoint. More importantly, the stochastic oscillator has jumped aggressively towards its overbought territory, potentially opening the door to a more protracted rally.

Should the bulls remain confident, they could try to overcome the busy 0.6060-0.6092 range, defined by the 38.2% Fibonacci retracement of the April 5, 2022 – October 13, 2022 downtrend, the July 14, 2022 low and the 100-day simple moving average (SMA). This would be the final step before pushing NZDUSD back inside the rectangle that has been in place since February 2023 and cancelling out the sell-off since early August.

On the flip side, the bears are probably determined to defend the key 0.6060-0.6092 area. If successful, they could then have a go at breaking the 0.5955 and 0.5920 levels set by the 50-day SMA and the May 15, 2022 low respectively. Even lower, the bears could then plot a course for the 23.6% Fibonacci retracement at 0.5870 that proved too strong during September.

To conclude, NZDUSD bulls have managed to stage a decent rally, but they probably need a break above the 0.6060-0.6092 range to confirm taking control of the market.