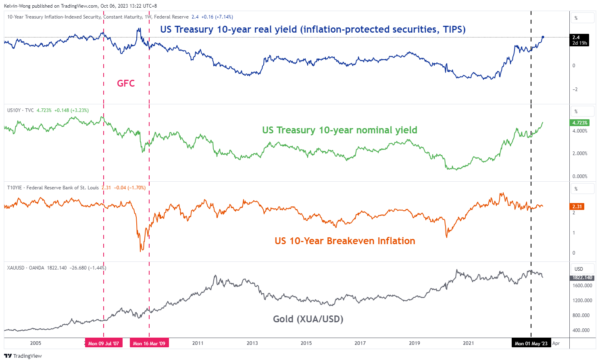

- Spot Gold (XAU/USD) has a significant indirect correlation with the 10-year US Treasury yield since May 2023.

- A potential short-term pull-back in US 10-year Treasury yield below a 4.90% key medium-term resistance may offer a “relief mean reversion rebound” on spot Gold.

- Watch the key support of US$1,810 on spot Gold.

In the past two weeks, the price of spot Gold (XAU/USD) has tumbled swiftly by -6.90% from its 21 September 2023 high of US$1,947 to a seven-month low of US$1,813 printed on Thursday, 5 October.

The primary driver has been the rapidly rising longer-term US Treasury yields that increase the opportunity cost of holding gold due to its “zero-yielding asset” nature. The 10-year US Treasury yield, a benchmark for long-term interest rates has increased by 158 basis points from its May 2023 low to a recent high of 4.88% on Wednesday, 4 October.

Fig 1: Spot Gold (XAU/USD) correlation with 10-year US Treasury yield as of 6 Oct 2023 (Source: TradingView, click to enlarge chart)

Potential pull-back for US 10-year Treasury yield

Fig 2: US 10-year Treasury yield medium-term trend as of 6 Oct 2023 (Source: TradingView, click to enlarge chart)

Its current short-term uptrend phase from the 1 September 2023 low of 4.06% has been overextended to the upside where it has formed a “Bearish Harami” right below a key-medium resistance of 4.90%, a two-candlestick bearish reversal pattern taking into account of its price actions on 3 and 4 October 2023 as seen on the daily chart.

Hence, the 10-yield US Treasury yield may start to shape a pull-back towards its 20 and 50-day moving averages acting as a support zone of 4.50%/4.33% that can provide some form of short-term ‘relief mean reversion rebound” for spot Gold (XAU/USD) given its significant indirect correlation with the 10-yield US Treasury yield since May 2023.

Watch the US$1,810 key medium-term support on Gold

Fig 3: Spot Gold (XAU/USD) major trend as of 6 Oct 2023 (Source: TradingView, click to enlarge chart)

Fig 4: Spot Gold (XAU/USD) minor short-term trend as of 6 Oct 2023 (Source: TradingView, click to enlarge chart)

The five-month medium-term downtrend phase of spot Gold (XAU/USD) from its 4 May 2023 high of US$2,067 has reached a key medium-term support of US$1,810 which is defined by the median line of the long-term secular ascending channel in place since December 2015 low and close to the 61.8% Fibonacci retracement of the prior major uptrend phase from 28 September 2022 low to 4 May 2023 high as seen on the daily chart.

On the shorter-term chart, the 1-hour RSI oscillator has flashed a recent bullish divergence condition at its oversold region which suggests that the downside momentum of its short-term downtrend phase from the 21 September 2023 high to 5 October 2023 low has eased.

These observations suggest a potential short-term counter trend mean reversion rebound scenario may occur next. A break above the near-term resistance of US$1,830 sees the next resistance coming in at US$1,860 (the median line of the medium-term descending channel from 4 May 2023 high & 38.2% Fibonacci retracement of the recent decline from 21 September 2023 high to 5 October 2023 low).

On the other hand, a break below the US$1,810 pivotal support invalidates the mean reversion rebound scenario to expose the next support at US$1,780 (minor congestion area from 15 November 2023 to 15 December 2022) in the first step.