- Upbeat longer-term inflationary expectations and business sentiment of large Japanese corporations could not derail the relentless up move of USD/JPY.

- Momentum factor and further potential 10-year US Treasury/JGB yield spread premium are supporting this current bout of rallies seen in USD/JPY at least in the short-term.

- The key resistances to watch will be at 150.00/150.30 and 150.80/150.90.

The bulls of USD/JPY have continued to charge forward and broke above last week’s high of 147.71 in today’s (2 October) Asian session as it printed a current intraday high of 149.82 at this time of the writing, just a whisker away from the key psychological level of 150.00.

This current bout of relentless up move of USD/JPY has come despite a better-than-expected Q3 Tankan survey report that indicated sentiment of both large manufacturers and non-manufactures have improved significantly.

The large manufacturers’ sentiment climbed to 9 points in Q3 from 5 points recorded in Q2 which was the highest print since Q2 2022 and surpassed consensus of 6 points. Similarly, the large non-manufacturers index rose to 27 points to a 32-year high in Q3 from 23 points in Q2, above the consensus of 24 points.

In addition, the Q3 Tankan survey report has also highlighted most Japanese firms expect an elevated inflationary trend where consumer prices are likely to stay above the Bank of Japan (BoJ) target of 2% for the next three to five years.

Fundamentally speaking, this latest set of key economic data should encourage some signs of intraday JPY strength to put a breather to the ongoing major uptrend of USD/JPY in place since mid-January 2023. But price actions have decided to move in the opposite direction against the latest fundamental factors and the latest round of “verbal interventions” out this morning’s Asian session from Japan’s Finance Minister Suzuki and Chief Cabinet Secretary Matsuno in an attempt to talk down the strength of USD/JPY.

Therefore, it seems that the current short-term bullish trend of USD/JPY seems to be supported by the momentum factor & the 10-year US Treasury yield premium expansion over the 10-year Japanese Government Bonds (JGBs).

US 10-year US Treasury/JGB yield spread is looking to eye 3.99% next

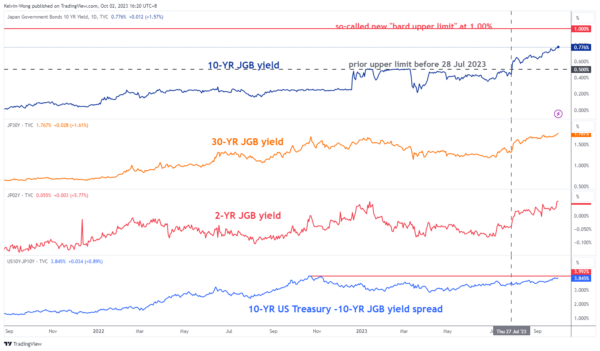

Fig 1: JGB yields medium-term trends with 10-year US Treasury/10-year JGB yield spread as of 2 Oct 2023 (Source: TradingView, click to enlarge chart)

Despite the current sticky rally seen in the 10-year JGB yield since ex-post 28 July 2023’s BoJ newly adjusted “flexible yield curve control” policy has hit 0.77% today, close to a 10-year high but the 10-year US Treasury yield has risen by a higher magnitude.

Therefore, the yield premium between the 10-year US Treasury and 10-year JGB has continued to expand in a steady uptrend and now looking to test the major resistance level of 3.99% with the current yield spread trading at 3.85% at this time of the writing. Hence, another potential positive 14 basis points (bps) up move in the yield premium may occur which in turn is able to support a further potential rally in the USD/JPY at least in the short term.

Bullish momentum breakout seen in daily RSI of USD/JPY

Fig 2: USD/JPY major & medium-term trends as of 2 Oct 2023 (Source: TradingView, click to enlarge chart)

The daily RSI indicator of the USD/JPY, a gauge of momentum has shaped a bullish momentum breakout on 26 September 2023 from a former consolidation in place since 16 August 2023 near its overbought zone.

These observations suggest that medium-term upside momentum remains intact which in turn supports a further potential up move in USD/JPY.

Oscillating within a minor ascending channel

Fig 3: USD/JPY minor short-term trend as of 2 Oct 2023 (Source: TradingView, click to enlarge chart)

As seen on the shorter-term 1-hour chart of the USD/JPY, its price actions have oscillated within a short-term minor ascending channel in place since the 1 September 2023 low of 144.44.

Watch the 149.16 key short-term pivotal support to maintain a potential short-term impulsive up leg sequence in the USD/JPY to see the next intermediate resistance coming at 150.00/150.30, and a break above it may see a further push up towards 150.80/150.90 major resistance (21 October 2022 swing high area & a cluster of Fibonacci extension levels).

On the other hand, a breakdown below 149.16 put the bullish tone in jeopardy for a corrective pull-back to expose the next intermediate support at 148.40/148.05 (also the 20-day moving average).