- GBPUSD set to close the month with heavy losses

- Short-term risk bearish but oversold conditions evident

- Support could emerge within the 1.2100 area

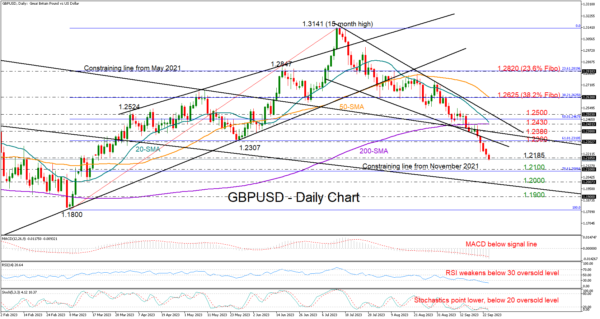

GBPUSD has been in the red almost every single week since peaking at a 15-month high of 1.3141 in mid-July, with selling forces intensifying significantly in September.

The pair is 4.0% down this month, suffering its worst month so far this year. It is currently trading near a six-month low of 1.2173, increasing speculation that the bearish cycle may end soon. Still, the RSI and the Stochastic oscillator are not showing any improvement, even though they have reached an oversold region. This means that sellers may continue to be active for some time before backing off.

The 1.2100 level is currently in sight. If the price slides below that floor, it may seek protection near the 1.2000 number. Running lower, it could take a breather near the 1.1900 area before meeting the 2023 low of 1.1800.

Otherwise, an immediate upside correction could shift the spotlight to the 1.2300-1.2380 trendline zone, where the 61.8% Fibonacci retracement level of the previous uptrend is also positioned. Slightly higher, the pair could battle a tougher obstacle within the 1.2430-1.2500 territory. The 20- and 200-day simple moving averages (SMAs), the 50% Fibonacci mark, as well as the resistance trendline from mid-July are adding credence to this region. Hence, a successful penetration higher is expected to activate fresh buying towards the 38.2% Fibonacci of 1.2625 and the 50-day SMA.

All in all, the short-term bias for GBPUSD remains skewed to the downside, though the non-stop collapse could spark an upside reversal as key support levels come in sight.