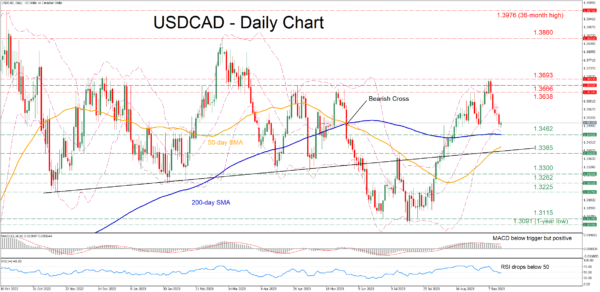

- USDCAD in an aggressive decline from its 5-month high of 1.3693

- Bears eye the crucial 200-day SMA

- Momentum indicators suggest more pain in the short term

USDCAD had staged a massive rebound after finding its feet at the one-year low of 1.3091 in mid-July. However, the pair has been undergoing a downside correction since its rejection at a fresh five-month peak of 1.3693 last week, with short-term oscillators suggesting that sellers have gained total control.

If the price extends its retreat, immediate support could be found at the 200-day simple moving average (SMA), currently at 1.3462. Sliding beneath that floor, the pair could retreat towards the May resistance of 1.3385, which might now serve as support. A violation of that territory could open the door for the April bottom of 1.3300.

Alternatively, bullish actions could propel the price higher towards the August resistance of 1.3638. Surpassing that hurdle, the pair may face the April high of 1.3666. Further advances could then cease at the recent five-month peak of 1.3693.

In brief, USDCAD has been losing ground since its latest advance encountered strong resistance at a fresh five-month high. Nevertheless, it’s too early to call for a sustained downtrend, unless the price profoundly breaks below the 200-day SMA.