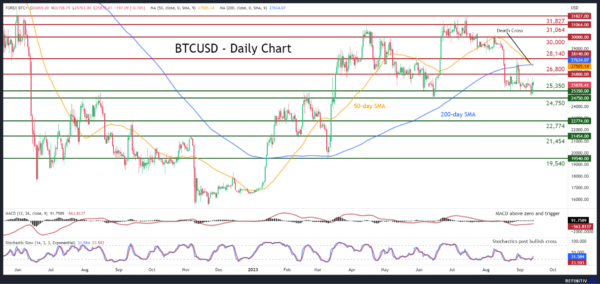

- Bitcoin hovers within 25,000-26,000 range in September

- Rebounded after posting fresh low just shy of June bottom

- Death cross points to more losses but momentum indicators diverge

BTCUSD (Bitcoin) has been trading without clear direction in the short term but extended its structure of lower lows. Interestingly, the completion of a death cross between the 50- and 200-day simple moving averages (SMAs) did not trigger a decline, with the short-term oscillators currently tilting to the bullish side.

If buying interest intensifies, the king of cryptos could initially test the August resistance of 26,800, a region that also provided support in March. A jump above that zone may pave the way for the 28,140 hurdle. Even higher, the crucial 30,000 psychological mark could prove to be a tough one for the price to overcome.

On the flipside, bearish actions could send the price to challenge 25,350, which held its ground three times in August and September. Piercing through that wall, the digital coin might then descend towards the June bottom of 24,750. Further retreats could then come to a halt at the 22,774 resistance territory, which could serve as resistance in the future.

Overall, BTCUSD remains stuck in a range amid diverging technical signals. Nevertheless, a break below the June bottom of 24,750 could be the starting point of a fresh downleg.