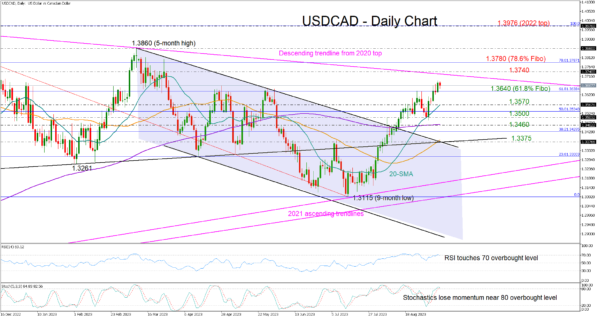

USDCAD bulls have been in charge for eight weeks in a row, currently aiming to push past the resistance trendline from 2020 that caused a bearish trend reversal in October 2022 and March 2023.

Given the overbought signals coming from the RSI and the stochastic oscillator, it’s uncertain whether the pair will manage to extend its uptrend above the tough trendline and the 1.3740 bar. The 78.6% Fibonacci mark of the 1.3976-1.3115 downtrend is nearby at 1.3780 and may attract some interest before all eyes turn to the 2023 peak of 1.3860. If the rally continues from there, the next target could be the 2022 top of 1.3976.

Should the bears take over below the 61.8% Fibonacci of 1.3640, the price could head for the 20-day simple moving average (SMA) at 1.3570. Slightly lower, the 1.3500 area might also provide some footing ahead of the flattening 200-day SMA at 1.3460.

In brief, USDCAD is maintaining a clear uptrend, but the risk of a downside reversal is increasing as the price is quickly approaching a critical resistance area.