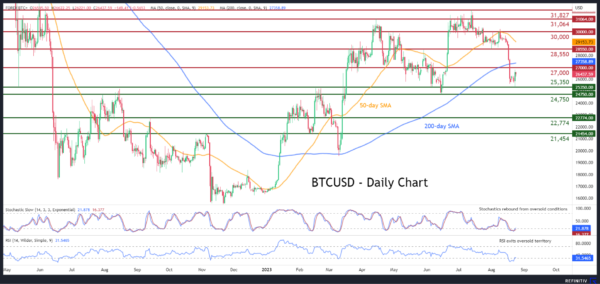

BTCUSD (Bitcoin) broke aggressively above its rangebound pattern on Tuesday, temporarily jumping above the 28,000 mark. However, the bulls lost the battle around the 200-day simple moving average (SMA), with the price slipping before entering a tight range in the last couple of sessions.

The momentum indicators currently suggest that near-term risks remain tilted to the upside. Specifically, the MACD is strengthening above both zero and its red signal line, while the stochastic oscillator is advancing steeply.

If buying interest intensifies, the king of cryptos could initially test the recent resistance of 28,140. Should that barricade fail, the spotlight could turn to 28,550, which acted both as support and resistance in August and May, respectively. Slicing through that region, the price may then advance towards the crucial 30,000 psychological mark.

On the flipside, bearish actions could send the price to challenge the March support of 26,520. Further declines could then cease at the recent two-month low of 25,350 ahead of the June bottom of 24,750. A violation of the latter could open the door for the 21,454 hurdle.

Overall, BTCUSD seems to be entering a consolidation phase as the 200-day SMA has so far repelled all upside attempts. Thus, a clear break above that barrier is needed for the rebound to resume.