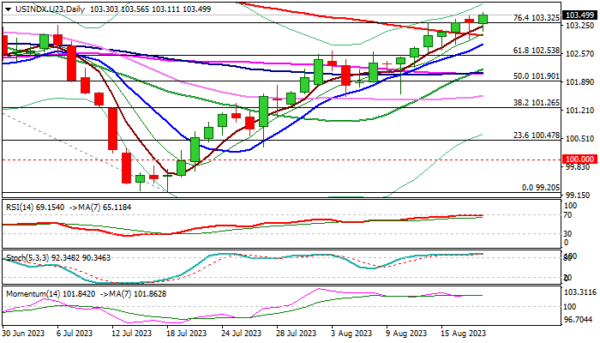

The Dollar Index hit new near two-month high on Friday, after price action slightly reduced speed on Thursday.

Break of Fibo resistance at 103.32 (76.4% of 104.59/99.20) marks fresh bullish signal, which looks for confirmation on weekly close above this level.

Long tails of recent daily candles point to strong demand, which contribute to firmly bullish daily studies and continue to underpin the price, offsetting warnings from overbought conditions.

The index is on track for the fifth consecutive week of gains, the largest uninterrupted advance since Apr/May 2022, which adds to positive outlook.

The downside should remain protected by broken 200DMA (103.01) to keep bulls intact for extension towards 104.59 (May 31 peak), with this week’s twist of weekly cloud also expected to attract bulls.

The dollar remains underpinned by increasing concerns over China’s economic growth and signals that US interest rates my stay high for some time, as recent economic data showed that US economy is resilient despite high interest rates.

Res: 103.72; 104.00; 104.33; 104.59.

Sup: 103.32; 103.01; 102.80; 102.53.