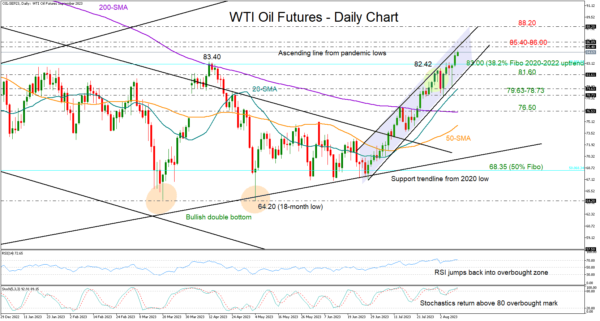

WTI oil futures snapped the 83.40 resistance on Wednesday, exiting marginally the long-term range area to reach a new high of 84.71 today.

The RSI and Stochastic oscillator are in the overbought zone, indicating the short-term bullish trend may stall soon as the price nears the upper limit of the upward-sloping channel at 85.40.

Should the bulls run above 85.40, claiming the 86.00 round level too, the door will open for the 88.20 barrier taken from the second half of 2022. The 92.50 bar, where the bulls paused in November 2022, could be the next target.

Alternatively, a downside reversal could see a retest of the 83.00-83.40 region, where the 38.2% Fibonacci retracement of the 2020-2022 uptrend is placed. If the price goes further down, it could hit the channel’s lower boundary at 81.60, a break of which could confirm another drop, probably towards the support zone of 79.63-78.73. From there, it might continue to fall towards the 200-day SMA at 76.50.

In short, the clear close above 83.40 is a bullish development for WTI oil futures, boosting optimism that the upward pattern could expand in the coming sessions. Yet, with the price trading slightly below a critical resistance area, another downside correction within the channel cannot be ruled out before buyers retake control again.