The Currency pair dropped significantly today and resumed the yesterday’s bearish candle. Price is pressuring an important dynamic support and is somehow expected to take this out. The USD has taken the lead on the short term and drives the rate down as the USDX has managed to increase again.

The dollar index was almost to erase the yesterday’s losses, remains to see if will have enough energy to stay higher and to approach the 93.81 horizontal resistance again. A failure to approach the 92.49 static support shows that the bulls are still in the game and could force the index to start a larger rebound.

The UK’s Public Sector Net Borrowing will be released later and is expected to increase from 5.1B to 5.7B in September, we’ll see if will have the ability to lift the cable.

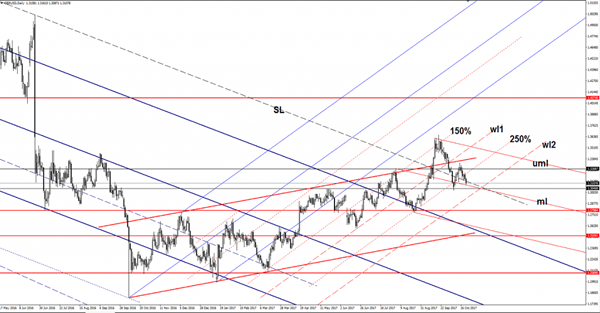

The GBP/USD drops after the breakdown below the 250% Fibonacci line and now is pressuring the outside sliding line (SL) of the major descending pitchfork. Price retested the median line (ml) of the minor descending pitchfork as well, but is somehow expected to ignore it and to drop much deeper.

I’ve said in the previous week that the perspective remains bullish as long as the rate stay above the 250% Fibonacci line, but another breakdown will signal a larger drop. Will drop towards the lower median line (lml) of the minor descending pitchfork if will close below the median line and if will retest this obstacle.