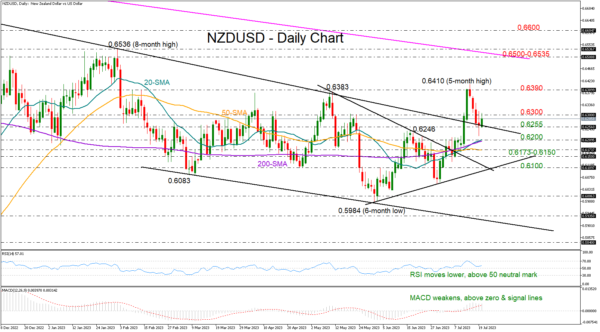

NZDUSD drifted higher on Thursday after four negative days, defending its summer uptrend above the 2022 resistance trendline and June’s high of 0.6246.

The RSI and the MACD have lost strength within the positive area, though they are still fluctuating above their neutral levels, keeping the risk skewed to the upside. Some optimism is also rising due to the double bullish crosses between the 20-day SMA and the longer-term SMAs, but traders will see if the crosses are lasting.

Should the pair close comfortably above Wednesday’s doji candlestick, and specifically above 0.6300, the recovery mood could strengthen towards last week’s bar of 0.6390. A continuation above 0.6400 could then target the 0.6500-0.6535 key resistance zone, where the crucial 2021 descending trendline is positioned. A decisive step above the latter would upgrade the long-term outlook from neutral to bullish, likely motivating fresh buying to 0.6600.

In the negative scenario, where the floor at 0.6255 cracks, the bears could re-challenge the 20- and 200-day SMAs around 0.6200. Even lower, the 50-day SMA at 0.6173 and the 0.6150 constraining area might prevent an aggressive downfall towards the tentative support trendline from June at 0.6100.

To sum up, NZDUSD could stay attractive to buyers if the 0.6255 floor stands firm, but for the pair to gain fresh impetus, the pair will need to climb above 0.6300.