The NZD/USD plunged aggressively in the yesterday’s trading session and erased the last week’s gains. Price ignored several downside obstacles and closed much below the 0.7055 previous low. However, remains to see if this is a valid breakdown, or the rate will come back higher. Technically, it could come to retest the broken levels before will resume the downside movement.

Is on a declining path and could reach fresh new lows in the upcoming weeks, this scenario will take shape only if the USDX will have enough energy to climb higher again.

The NZD/USD dropped somehow surprisingly as the USDX has dropped significantly on Thursday. The dollar index moves in range on the short term and still maintains a bullish bias despite the last day’s drop. I’ve said in the previous days that the USDX could decrease a little again because I don’t believe that will have enough directional energy to take out the 93.81 static resistance.

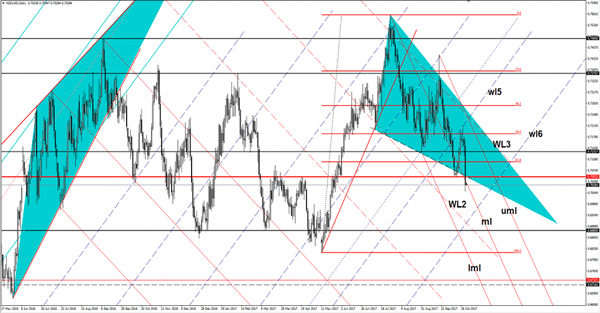

Price dropped like a rock and now stands below the 0.7055 previous low and below the median line (ml) of the minor descending pitchfork. A valid breakdown below the median line (ml) signals a further drop in the upcoming period, but a fakeout will drive the rate towards the 0.7055 level again. I’ve said in the last days that technically it should come down to retest the median line (ml) after the retest of the wl5 and after the failure near this level and above the 50% Fibonacci level.