FX volatility might be returning given Wall Street is seeing some exhaustion with several key currency trades. The end of tightening for the advance economies keeps getting delayed and sooner than later it will deliver a major blow to growth. FX volatility should pick up as diverging policies from the Fed, BOE, and PBOC could trigger some significant moves in H2.

USD/JPY

A lot of macro traders were expecting dollar strength to intensify against the Japanese yen as interest rate differentials appear likely to widen further over the next few months. The carry trade isn’t making a comeback given the rising prospects of a recession coming to the US. Everyone also remains on intervention watch from Japan’s Ministry of Finance, but expectations are for action if dollar-yen tests the 150 region. The consensus on Wall Street is that Japan will probably act, but it might not happen until after the summer. A tweak to yield curve control could trigger yen strength but that won’t happen until the BOJ’s price goal is achieved. BOJ Governor Ueda has been clear that no tweaks will occur until the prospects heighten for inflation to sustainably reach its 2% target.

USD/JPY weakness towards 140 has triggered some buyers and that might gain momentum if risk appetite can remain throughout tomorrow’s US inflation report (Wednesday 830am est). Further upside could eye a return to the 145 zone if risk aversion does not run wild post both Wednesday’s CPI reading and Friday’s bank earnings.

GBP/USD

GBP/USD (4-hour chat) has been in a general rally for the past two days, but that could be coming to an end if a bearish butterfly pattern forms. The headlines have been mostly bullish for the pound, but that could be reaching an inflection point. Inflation is forcing the BOE to be extremely hawkish and that could soon lead to a significant economic downturn. Many traders are focusing on today’s UK wage growth, as it posted the biggest rise outside the pandemic period, but jumps in jobless claims suggest the labor market is cooling.

If the pound-dollar bullish trend respects the psychological 1.3000 resistance, some bullish bets might get taken down. The four-hour GBP/USD is displaying a potential bearish butterfly pattern. If this technical reversal pattern holds, a moderate decline could see downward momentum target the 1.2800 region. If a dramatic move triggers a rally above the 1.3000 level, the bearish reversal pattern could be invalidated. Further upside targets include the 1.3250 region.

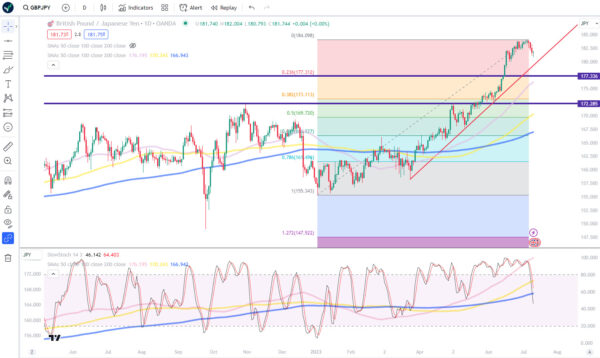

GBP/JPY

The British pound has appreciated over 18% to the Japanese yen this year as stubborn inflation has bolstered the odds of aggressive central bank tightening by the BOE. Pound-yen has steadily gathered strength in the first half of the year but exhaustion could be settling in. The pound initially rallied earlier in London after weekly hourly earnings came in scorching hot, which should raise the prospects of a half-point rate hike at the August 3rd BOE meeting. The pound may get a major boost against the dollar if it can extend above the 1.30 level, but for some traders it is looking toppish against the yen.

GBP/JPY may have a decent pullback if continued bearishness takes price below the bullish trendline that has been in place since March. Pound downside momentum could target 176.50 against the yen if the bullish trend line (around the 179.75 ) is invalidated.

Key resistance currently resides around the 184.20 level.

USD/MXN

The Mexican peso is one of top-performing currencies of the year and that trade is starting to lose momentum. The interest rate differential (Banxico overnight rate stands at 11.25%) and robust economic growth prospects have made the peso a very attractive trade this year. A weakening global growth outlook however will start to dampen prospects for EM currencies. Emerging markets need their key trading partners to thrive and China’s disappointing economic recovery is triggering some profit-taking.

USD/MXN has major support at the 17.00 level and if a rebound emerges, upside could target the 50-day SMA around the 17.45 level. Given the softening outlook for the next year, peso weakness to the dollar could eventually target the 20.00 level.