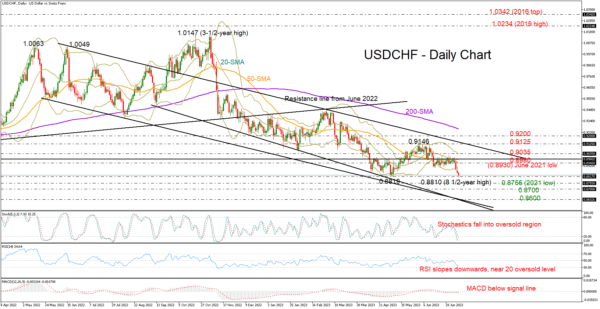

USDCHF went downhill to print an eight-and-a-half year low of 0.8810 slightly below May’s trough on Tuesday after getting rejected near its 20-day simple moving average (SMA).

Another leg down is possible as the RSI and the stochastic oscillator have yet to bottom out in the oversold area. Yet, with the price set to close below the lower Bollinger band for the second consecutive day, a turning point could be near.

If the price sinks below May’s trough of 0.8819, the next stop could be somewhere between the 2021 low of 0.8755 and the 0.8700 psychological mark. Running lower, the bears might face a tougher battle near 0.8600, where two support lines interest each other.

Alternatively, an upside reversal will aim for a close above the 20-day SMA at 0.8940 and the key bar of 0.8980. If the latter gives way, the upper Bollinger band at 0.9035 might immediately cap the price, delaying an extension towards the one-year-old resistance trendline at 0.9125. A faster rally could bring the 0.9200 level under the spotlight.

In a nutshell, USDCHF sellers could stay active in the short-term. A sustainable move below 0.8819 could mark a new lower low within the 0.8755-0.8700 area.