In May, against expectations of a slowdown, inflation stubbornly held at 8.7%, creating additional pressure on the Bank of England. This comes just a day before the anticipated 13th consecutive interest rate hike to curb price growth. The headline figure places British inflation at the top among major advanced economies. These numbers aren’t exactly comfortable for Prime Minister Rishi Sunak, who aimed to cut inflation by half this year before the 2024 election. Moreover, they could lead to increased mortgage costs for homeowners. Economists suggest that the Monetary Policy Committee may need to substantially raise the Bank Rate in the coming months to address the situation. As a result of the release of these figures, the sterling briefly rose against the U.S. dollar and the euro, while two-year government bond yields reached their highest levels since July 2008. Market expectations have shifted, with a 40% chance that the Bank of England will increase rates by half a percentage point to 5% instead of the previously anticipated quarter-point move. By December, there is a 60% chance of rates reaching 6%. The current figures strengthen the case for the government to stay on its chosen path. However, the opposition party Labour has emphasized its focus on the cost of living if it were to come into power. Core inflation, which excludes volatile items, rose unexpectedly to 7.1%, the highest since March 1992, while services price inflation reached its peak since 1992 at 7.4%. Some relief may come from a slowdown in producer price inflation, although expectations of the BoE raising rates six more times to 6% may be excessive.

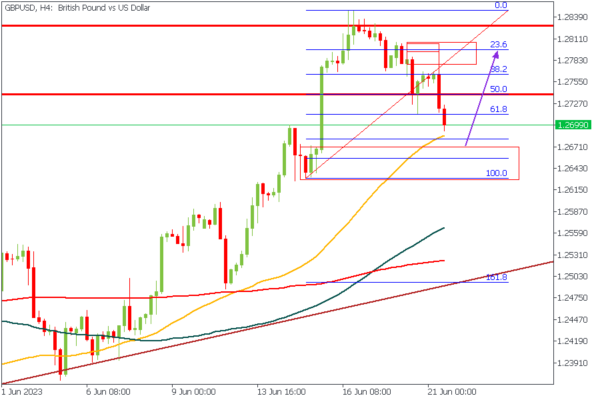

GBPUSD – 4 Hours Timeframe

GBPUSD was rejected earlier from the weekly pivot, but the price action needs to be more convincing. This may be due to the drop-base-rally demand zone, as the chart above highlights. Also, the moving averages are still clearly aligned in increasing order, often indicating that a bullish trend is in motion. Considering the demand zone, the Fibonacci retracement level, and the 50-period moving average, I will wait for a clear entry based on my convictions (as I’d advise you to do too).

Analyst’s Expectations:

- Direction: Bullish

- Target: 1.27204

- Invalidation: 1.26307

GBPAUD – Daily Timeframe

GBPAUD is heading even higher toward the marked supply zone. The bullish price action may have lost momentum, but we will see the continuation of the bullish pressure in a short while. At this time, my sentiment on GBPAUD is bullish, mainly based on the following sentiments;

- Strong bullish previous day candle

- Microstructure is already broken in a bullish direction

- Bullish moving average array

Analyst’s Expectations:

- Direction: Bullish

- Target: 1.89740

- Invalidation: 1.87380

GBPJPY – 4 Hours Timeframe

GBPJPY has just been pushed back out of the weekly pivot zone by immense selling pressure in the market. This seems to suggest that we should see a fresh wave of sellers entering into the market to push GBPJPY even further down toward the 50-period moving average at the very least.

Analyst’s Expectations:

- Direction: Bearish

- Target: 179.307

- Invalidation: 181.621

GBPCAD – Daily Timeframe

The current position of GBPCAD, as revealed by the chart above, shows that the price action is currently resting on a rally-base-rally demand zone, with a confluence from the 50-Day moving average. Based on the bullish array of the moving averages, demand zone, and trendline support, we may expect to see even higher prices on the GBPCAD currency chart over the next few days.

Analyst’s Expectations:

- Direction: Bullish

- Target: 1.70078

- Invalidation: 1.66851

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.