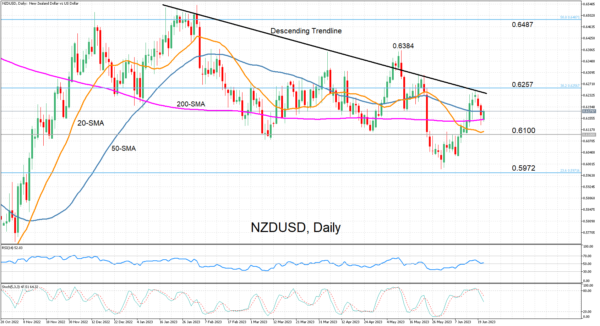

NZDUSD appears to have found its feet around the 200-day simple moving average (SMA) following the pullback from the June top of 0.6246. But the fact that the latest upleg was unable to breach the medium-term descending trendline casts into doubt the prospect for a bullish break in the near term.

The momentum indicators are sending mixed signals about the short-term picture. The stochastic oscillator continues to point down but the RSI suggests the selling pressure is easing as it has settled just above the 50-neutral level.

If the bulls manage to regain the upper hand and push above the 50-day SMA, the descending trendline will again turn into a battleground, especially with the 38.2% Fibonacci retracement of the 2021-2022 downtrend lying slightly higher at 0.6257. Higher up, the May high of 0.6384 will be the next major test ahead of the February top of 0.6537.

However, should the bounce off the 200-day SMA quickly run out of steam and NZDUSD resumes its downfall, the 20-day SMA is expected to do its bit in supporting the bulls as it’s hovering just above the key 0.6100 handle. But if broken, the pair could slide all the way until the 23.6% Fibonacci of 0.5972, creating another lower low.

In the bigger picture, the pair remains within a bearish channel despite several failed attempts at a rebound. For the bulls to have any winning chance of switching the outlook to positive, they not only have to lift the price above the descending trendline, but also above the May peak.