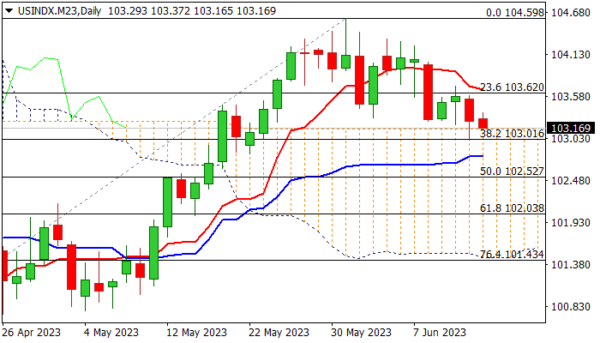

The dollar index is standing at the back foot and consolidating above three-week low in early Wednesday, following Tuesday’s post-US CPI drop and subsequent bounce which kept the price action above key supports at 103.15/01 (top of thick daily cloud/Fibo 38.2% of 100.45/104.59).

Near-term picture remains bearishly aligned, weighed by rising negative momentum and 10/20DMA bear-cross, but the action needs to see clear break of 103.15/01 pivots to signal bearish continuation and open way for deeper drop.

The demand for dollar dropped on softer than expected inflation in May which added to strong expectations that Fed will pause rate hikes this time, though the consumer prices are still twice the Fed target and core inflation at 5.3%, providing a little relief.

Markets see a pause in policy tightening as likely scenario, but even in case of no more hikes in coming months, the borrowing cost is expected to remain high for some time, which would underpin the dollar in the longer run.

Res: 103.67; 104.00; 104.33; 104.58.

Sup: 103.01; 102.83; 102.57; 102.03.