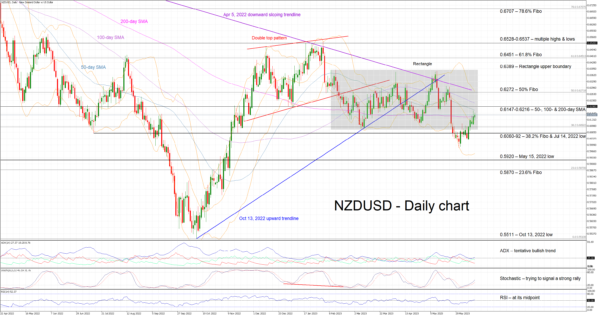

NZDUSD has returned inside the rectangle that has been dictating the price action since February 2023 as the recent bearish breakout proved to be false. This move has clearly dented the NZD bears’ confidence, but they have to react quickly in order to contain the bullish pressure.

NZDUSD is currently hovering around the 200-day simple moving average (SMA) as the momentum indicators are tentatively supporting the current upleg. The Average Directional Movement Index (ADX) is edging higher, signaling a decent bullish trend, and the RSI is hovering just above its 50-midpoint. More interestingly, the stochastic oscillator is edging higher, opening a sizeable gap from its moving average, and hence pointing to the continuation of the current rally.

If the NZD bulls try to further capitalize on the failed bearish breakout, they have to break the busy 0.6147-0.6216 area that is defined by the 50-, 100- and 200-day SMAs. Higher, the 50% Fibonacci retracement of the April 5, 2022 – October 13, 2022 downtrend at 0.6272 could prove tougher to crack than anticipated.

On the other hand, if the NZD bears decide to negate the current bullish move, they have to push the pair below the 200-day SMA. They would then have to recapture the 0.6060-0.6092 range populated by the 38.2% Fibonacci retracement and the July 14, 2022 low respectively. Another bearish breakout looks premature but if the NZD bears appear confident, they would set their eyes on the May 15, 2022 low at 0.5920.

To sum up, NZDUSD bulls have the chance for a strong rally following the false bearish breakout, as the bears look for the appropriate area to set up their defence.