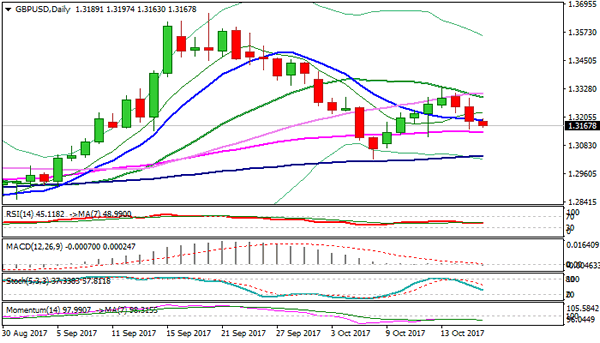

Cable holds in red in early Wednesday’s trading but still above Tuesday’s low at 1.3154 and pivotal supports at 1.3145/41 (Fibo 61.8% of 1.3026/1.3337 upleg / 55SMA). Tuesday’s weakness was rejected at 1.3154 and failed to close below daily Tenkan-sen (1.3182), but negative bias persists for fresh attempts lower after pound fell significantly in past two days. Asian trading was capped by falling 10SMA at 1.3200 zone, maintaining negative stance for fresh probe through 1.3145/41, for test of 1.3100 (Fibo 76.4%) and top of thin daily cloud at 1.3082 which continues to attract bears. UK jobs data are in focus today. Average earnings are expected to stay unchanged at 2.1% in September, while jobless claims are forecasted for 1K rise in September after falling by 2.8K previous month. Unemployment rate is forecasted unchanged at 4.3% in August. Weaker than expected earnings would put pound under increased pressure, while better than expected jobs numbers would boost sterling and sideline immediate downside risk.

Res: 1.3182, 1.3197, 1.3225, 1.3286

Sup: 1.3154, 1.3141, 1.3121, 1.3100