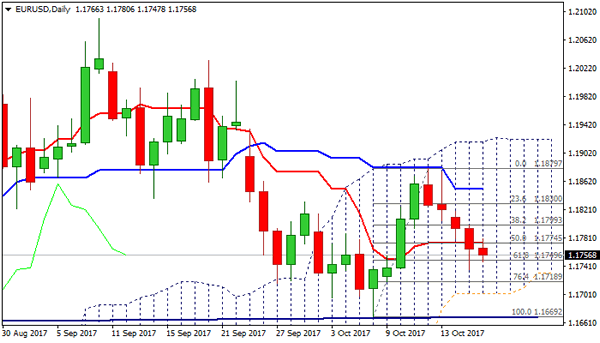

Action in Asia/early Europe was choppy and shaped in long-legged Doji, signaling no clear direction. Strong bears of past four days are taking a breather above cracked support at 1.1749 (Fibo 61.8% of 1.1669/1.1879 upleg, but underlying bear-trend from 1.1879 high remain intact, as bearish signal was generated on Tuesday’s close below daily Tenkan-sen (1.1774).

Near-term action targets daily cloud base (1.1702), break of which would generate fresh bearish signal for extension towards another key support at 1.1669 (06 Oct low/neckline of larger H&S pattern, formed on daily chart). Base of thick falling hourly cloud and broken 10SMA cap today’s action (1.1782) and should ideally limit upside attempts, however, extended upticks should remain under top of hourly cloud (1.1815) to keep near-term bearish bias in play.

Res: 1.1782, 1.1800, 1.1815, 1.1851

Sup: 1.1749, 1.1702, 1.1669, 1.1620