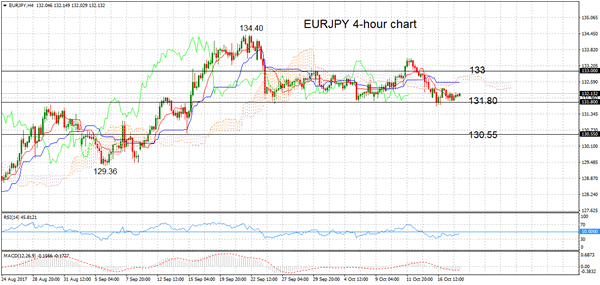

EURJPY has been neutral since September 25, trading in a broad range between 131.80 and 133.00. Trend and momentum indicators are pointing to more sideways trading in the short-term.

On the 4-hour chart, RSI and MACD are flat, while the Ichimoku cloud analysis also shows a lack of direction in the market.

EURJPY is currently trading at the lower end of the range, with support at 131.80. Immediate risk is tilted to the downside. Breaking below this level would target 130.55 ahead of the September low of 129.36.

Prices would need to break above the 133.00 level to improve the odds for an extension up to 134.40, a level not seen since November 2015. Clearing this peak would see a resumption of the longer-term uptrend.

The intraday bias is neutral as prices consolidate just above the lower end of the broader range. In the bigger picture, EURJPY is lacking direction after pausing and pulling back from a strong rally in September.