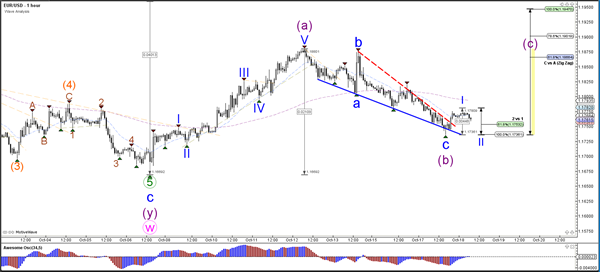

Currency pair EUR/USD

The EUR/USD bounced at the 61.8% Fibonacci level of potential wave B (purple). A break above the resistance trend line (orange) would confirm a bullish breakout within wave C of wave X (pink). A break below the support trend line and 78.6% Fibonacci level makes a bullish ABC less likely and price will probably continue lower as part of wave 4 (light purple).

The EUR/USD broke above the falling wedge (dotted red) and could be building a wave 1-2 if price stays above the 100% Fibonacci level of wave 2 vs 1.

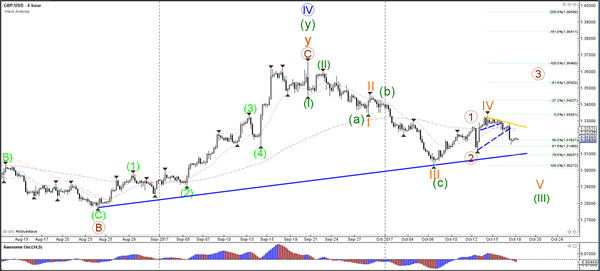

Currency pair GBP/USD

The GBP/USD offers two main scenarios where either a bearish ABC (green) or a wave 123 (green) is taking place. Price invalidates that wave 4 (orange) correction if price breaks above the resistance trend line (yellow). A break below the support trend line (blue) increases the chance of a bearish break within wave 5 (orange).

The GBP/USD broke below tow support trend lines (dotted blue) and fell towards the 50-61.8% Fibonacci levels. A bounce and break above resistance (yellow) could indicate a bullish structure whereas a bearish break could continue the wave 5 (orange).

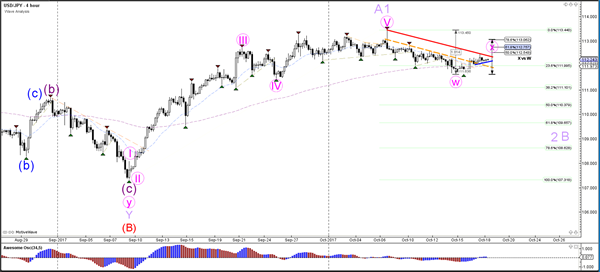

Currency pair USD/JPY

The USD/JPY could be building a larger WXY (pink) correction within wave 2 or B (purple).

The USD/JPY bullish break above the resistance trend line (dotted red) could be part of a bullish wave X (pink) correction.