Key Highlights

- GBP/USD started a fresh decline below the 1.2550 support.

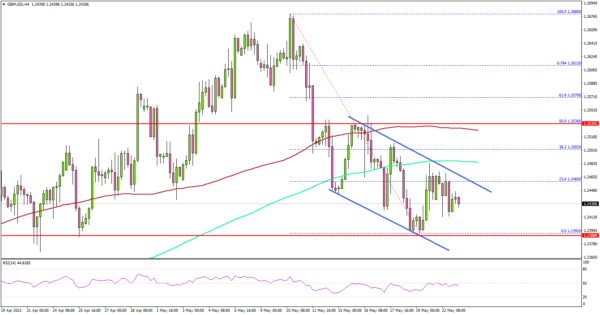

- A major declining channel is forming with resistance near 1.2455 on the 4-hour chart.

- EUR/USD is struggling to recover above the 1.0840 resistance.

- The US Manufacturing PMI could decline from 50.2 to 50.0 in May 2023 (Preliminary).

GBP/USD Technical Analysis

The British started a fresh decline from well above 1.2620 against the US Dollar. GBP/USD traded below the 1.2550 support to move into a bearish zone.

Looking at the 4-hour chart, the pair settled below the 1.2500 level, the 100 simple moving average (red, 4 hours), and the 200 simple moving average (green, 4 hours).

It even traded below the 1.2440 support level. A low is formed near 1.2392 and the pair is now consolidating losses. Immediate resistance is near the 1.2440 level. There is also a major declining channel forming with resistance near 1.2455 on the same chart.

The next major resistance is near 1.2485 and the 200 simple moving average (green, 4 hours), above which the pair could rise toward the 1.2520 level.

The main resistance is now near 1.2500 and the 100 simple moving average (red, 4 hours), above which GBP/USD could gain bullish momentum. On the downside, the pair might find support near 1.2390.

The next major support is near the 1.2360 level. If there is a downside break below the 1.2360 level, the pair could decline toward the 1.2300 support level. The next major support sits near the 1.2250 level.

Looking at EUR/USD, the pair is still struggling to recover above 1.0840 and remains at risk of more losses in the near term.

Economic Releases

- Germany’s Manufacturing PMI for May 2023 (Preliminary) – Forecast 45.0, versus 44.5 previous.

- Germany’s Services PMI for May 2023 (Preliminary) – Forecast 55.5, versus 56.0 previous.

- Euro Zone Manufacturing PMI for May 2023 (Preliminary) – Forecast 46.2, versus 45.8 previous.

- Euro Zone Services PMI for May 2023 (Preliminary) – Forecast 55.6, versus 56.2 previous.

- US Manufacturing PMI for May 2023 (Preliminary) – Forecast 50.0, versus 50.2 previous.

- US Services PMI for May 2023 (Preliminary) – Forecast 53.6, versus 53.6 previous.