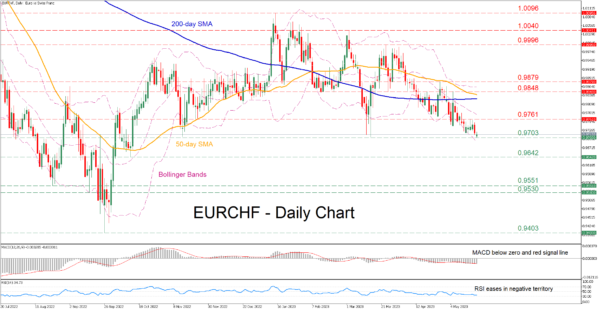

EURCHF has been trending lower since its latest rebound got rejected just shy of the parity level in late March. In today’s session, the pair posted a fresh seven-month low of 0.9703 before recouping some losses, indicating that this recent downtrend could resume.

The momentum indicators currently suggest that bearish forces are holding the upper hand. Specifically, the MACD is softening below both zero and its red signal line, while the RSI is flatlining near its 30-oversold zone.

If the price extends its retreat below today’s seven-month low, the October 2022 support of 0.9642 might prove to be a tough obstacle for the pair to overcome. If that barricade fails, the spotlight could turn to the August low of 0.9551 before the September support of 0.9530 appears on the radar. A violation of the latter may open the door for the 2022 bottom of 0.9403.

Alternatively, should the decline falter and the price reverse upwards, the bulls could attack the recent resistance of 0.9703. Crossing above that zone, the price could ascend towards 0.9848 or higher to challenge the April resistance of 0.9879. Further advances could then cease at the 0.9996 region.

Overall, EURCHF seems ready to extend its structure of lower highs and lower lows, while a potential completion of a death cross between the 50-day simple moving average (SMA) and the 200-day SMA could induce further negative pressures.