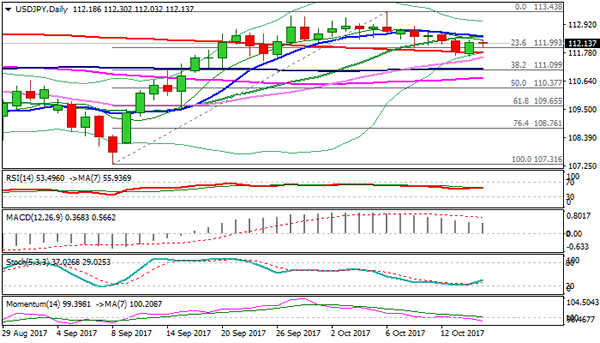

The pair is trading above 112.00 handle on Tuesday, following bounce on Monday and repeated failure to close below 200SMA (111.77).

The 200SMA marks pivotal support which was dented twice (dips to 111.68 and 111.65) but so far without clear break lower.

Repeated downside failure could hurt near-term bears on sustained break above converged 10/20SMA’s (112.42) which could shift near-term bias higher.

Stronger direction signals could be expected on break of 200SMA of 10/20SMA pivots.

Downside action on sustained break below 200SMA would open 111.33 (daily Kijun-sen) and 111.09/110.90 (100SMA / daily cloud top) in extension.

Conversely, firm break above converged 10/20SMA’s would expose 112.80/113.00 resistance zone initially.

Res: 112.30, 112.42, 112.54, 112.80

Sup: 112.03, 111.76, 111.65, 111.33