The Euro remains in red on Tuesday and accelerated further down against strengthening greenback which received fresh support on comments that President Trump favors more hawkish next head of the Federal Reserve.

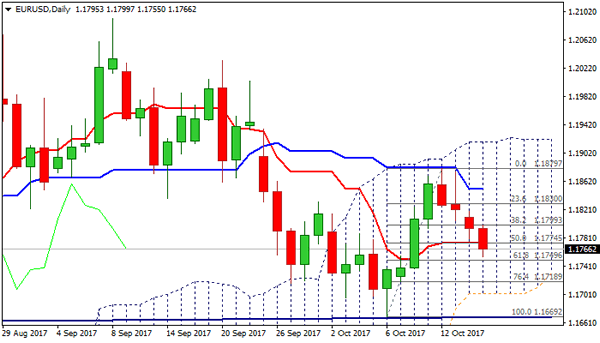

The pair generated bearish signal on Monday’s close below 1.1800 (Fibo 38.2% of 1.1669/1.1879 upleg) with fresh bearish acceleration on Tuesday, taking out daily Tenkan-sen support at 1.1774 and pressuring next pivot at 1.1749 (Fibo 61.8%).

Bearish daily studies support for further downside as recent weakness is on track to complete Head & Shoulders pattern on daily chart, which could spark further downside on break below the neckline at 1.1669.

Bears need clear break below 1.1749 Fibo support to unmask daily cloud base at 1.1702 and threaten 1.1669 (former low of 06 Oct / H&S neckline).

Broken Tenkan-sen / 10SMA offer immediate resistance at 1.1774/79, followed by falling 20SMA (1.1802).

EU CPI data are in focus today (Sep CPI m/m is forecasted at 0.4% vs 0.3% prev, while annualized inflation is expected to stay unchanged at 1.5% in September).

Divergence from forecasted levels would have stronger impact on pair’s near-term action.

Res: 1.1774, 1.1802, 1.1851, 1.1879

Sup: 1.1749, 1.1702, 1.1669, 1.1620