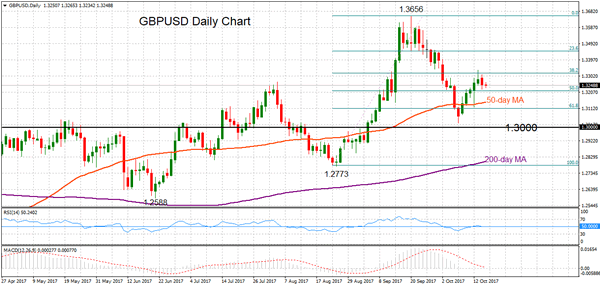

GBPUSD has turned neutral in the near term after the recent bounce from the key 1.3000 area. It remains to be seen whether the market is making a lower top at 1.3337 and will continue the bearish phase from the 1.3656 peak.

Risk is still tilted to the downside and further weakness is expected since momentum signals are weak. MACD is bearish while RSI is flat.

Immediate support is at 1.3216, which is the 50% Fibonacci retracement level of the upleg from 1.2773 to 1.3656. Below this level support is expected at 1.3112, which is the 61.8% Fibonacci mark. A deeper decline would target the key 1.3000 area and from here the August 24 low at 1.2773 will come into view.

Immediate resistance is at 1.3319 (38.2% Fibonacci) and above this at 1.3446 (23.6% Fibonacci). From here GBPUSD would re-test the 1.3656 peak and then resume the uptrend that started from 1.2773.

In the bigger picture, the short-term bearish phase appears to still be in progress and the corrective move off 1.3000 has reversed back down. Only a rise back above 1.3300 would indicate that the short-term bearish phase from 1.3656 has ended.