Bitcoin was unable to continue its bullish momentum from last week, and after touching a high of $29,829 on May 06, we can see a continuous decline in the bitcoin price, with immediate targets located in the range of $26500 and $27000.

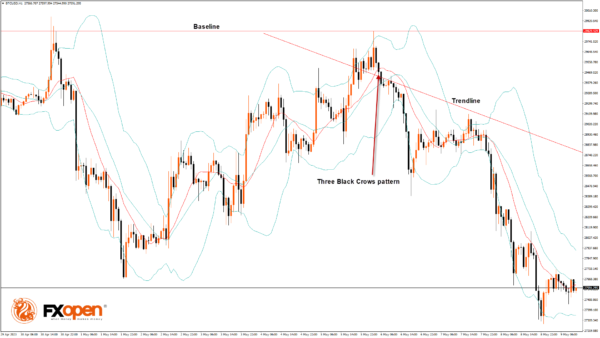

We can clearly see a bearish three black crows pattern below the $29,829 handle on the H1 timeframe.

The price of Bitcoin continues to move in a bearish momentum, which is expected to continue towards the $27,000 handle.

Both the STOCH and Williams’s percent range indicate overbought levels, which means that in the immediate short term, a decline in the price is expected.

The Bitcoin chart is ranging near a new record low for 1 month.

The relative strength index is at 39.90, indicating a very weak demand for Bitcoin and the continuation of the selling pressure in the markets.

Bitcoin is now moving below its 100-hour exponential moving average and below its 200-hour exponential moving average.

Most of the major technical indicators are giving a bearish signal, which means that in the immediate short term, we are expecting targets of $26,500 and $27,000.

The average true range indicates less market volatility with mild bearish momentum.

- Bitcoin bearish reversal is seen below $29,829.

- The RSI remains below 50, indicating a bearish market.

- The price is now trading below its pivot level of $27,622.

- The short-term range is mildly bearish.

- The momentum indicator is back under zero.

Bitcoin Bearish Reversal Seen below $29,829

The price of Bitcoin entered into a consolidation zone above the $27,000 handle after which we can see the continuation of the bearish moves.

There is a bullish trend reversal pattern with adaptive moving average AMA-20 and AMA-50 in the daily timeframe.

We can see the formation of bearish engulfing lines in the 4-hourly timeframe.

We have also seen a bearish harami cross pattern located in the 15-minutes timeframe.

A support zone is located at $26,092, which is a 61.8% retracement from the 52 week low, and at $26,670, which is a 3-10 day MACD oscillator stalls .

BTCUSD is now facing its classic support level of $27,454 and Fibonacci resistance level of $27,583 breaking which the price will be able to move to $27,000.

There is an increase of 3.08% in the daily trading volume, which is normal. The short-term outlook for Bitcoin is bearish, the medium-term outlook has turned bearish, and the long-term outlook remains neutral under present market conditions.

The Week Ahead

We can see that Bitcoin price remains well supported above the $27,000 handle and the continuation pattern is seen, with the current support at $25,281, which is a 50% retracement from 13 week high/low.

The immediate expected target is $26,500, after which we may see some consolidation in the zone of the $27,000 level.

Monthly RSI is at 49.79, which indicates the Neutral market and the shift towards the consolidation zone in the medium-term range.

We can see the formation of a bearish trend line from $29,829 to $27,356.

The BTCUSD is now facing resistance at $28,051, which is a 14-3 day raw stochastic at 30%, and at 28,266 which is a 14 day RSI at 50%.