WTI contract is holding in recovery mode for the second straight day, following a dramatic fall this week, which hit the lowest since Dec 2021 before bouncing.

Oil was down over 15% before regaining ground, pressured by growing fears about US recession and turbulence in banking sector, as well as weaker than expected China’s manufacturing data which add to the risk of weaker demand from world’s largest oil importer.

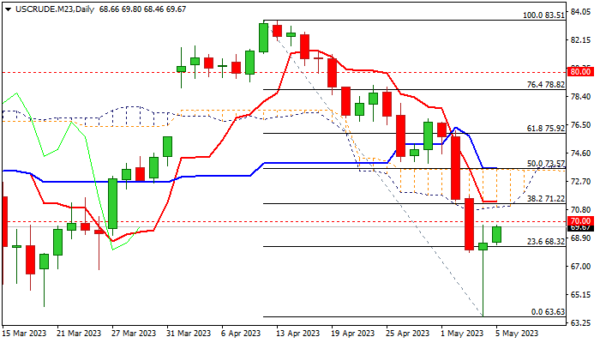

Quick rebound which left a daily candle with very long tail on Thursday, points to strong bids at the zone of former multi-month low at $64.34 (Mar 20).

Recovery is likely to mark a price adjustment and offer better selling levels as the picture on daily chart is firmly bearish and warn of fresh weakness on persisting negative fundamentals.

Correction is still holding below psychological $ 70 resistance, break of which may spark further upside as next week’s daily cloud twist could be magnetic.

Extended upticks should be capped by strong barriers at $71.06/33 zone (daily cloud base / Fibo 38.2% of $83.51/$63.63 daily Tenkan-sen) to mark a healthy correction before bears regain control.

Firm break of recent lows ($64.34/$63.63) to challenge immediate supports at $62.42 and $61.79 (Dec/Aug 2021 troughs) and risk acceleration towards $53.87 (Fibo 61.8% of $6.32/$130.48) if fundamental picture worsens.

Only break above $73.57 (daily Kijun-sen / 50% retracement of $83.51/$63.63) would sideline downside risk and generate reversal signal.

Res: 70.00; 71.06; 71.33; 73.57.

Sup: 68.32; 67.94; 66.81; 64.34.