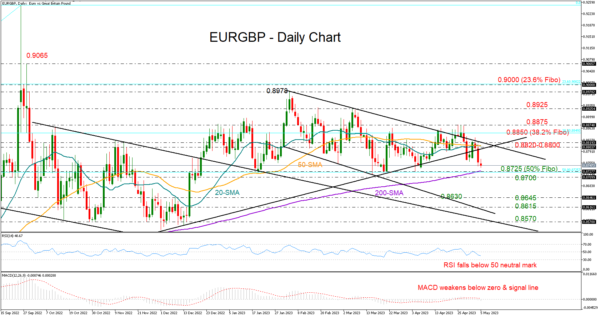

EURGBP erased Tuesday’s fast pickup, extending its two-day decline to a new one-month low of 0.8740 early on Friday.

The bulls ran out of fuel near the 38.2% Fibonacci retracement of the 0.8201-0.9249 uptrend at 0.8850 and the upper boundary of the three-month-old bearish channel, increasing speculation that a new bearish wave might be now in progress. Adding to the negative risks is Thursday’s close below the support trendline drawn from August’s lows seen at 0.8800.

The RSI and the MACD are raising a red flag too as the former is sloping downwards below its 50 neutral mark and the latter is decelerating within the negative region. Still, the bears may not take control unless the 0.8725-0.8700 zone, where the 200-day simple moving average (SMA) meets the 50% Fibonacci level, gives way. A clear step lower could activate an aggressive downfall towards the 0.8645 hurdle, while a steeper decline could reach the channel’s lower band seen near 0.8615.

A bounce higher may initially re-challenge the 0.8800-0.8820 bar ahead of the 0.8850-0.8875 resistance region. If the bulls successfully claim the latter, the recovery may stretch towards the 0.8925 barricade and then up to the key 0.8978-0.9000 territory.

In a nutshell, EURGBP is expected to face additional selling pressure in the short term, with the confirmation likely coming below 0.8725-0.8700.