It’s no longer news that Eurozone’s headline inflation rate rose in April, exceeding the European Central Bank’s target. Eurostat’s preliminary data revealed that the headline inflation rate reached 7% last month, a 0.1% rise from 6.9% in March. In contrast, core inflation, which excludes food and energy prices, unexpectedly slowed to 5.6% in April. The latest figures come right after the ECB’s policy decision on Thursday, 4th of May, with market players speculating on a possible 25 or 50 basis point increase. The higher headline inflation rate could lead to a 50 basis point hike, while the slower core price growth could push for a more dovish stance with a 25 basis point hike. Despite the consistent rate increases, inflation in the Eurozone remains above the ECB’s target of 2%, and further tightening is required to defeat inflation, according to the IMF’s Alfred Kammer.

EURUSD – H4 Timeframe

In line with my previous analysis here (https://fbs.com/analytics/articles/can-usd-reverse-in-april-37668), EURUSD remains somewhat stranded inside the weekly supply zone. The most encouraging indicator for a bearish move is the recent breakout of the wedge pattern. My confirmation for this sentiment is based on the trendline resistance, the rally-base-drop supply zone, and the 76% of the Fibonacci retracement tool.

Analysts’ Expectations:

- Direction: Bearish

- Target: 1.11011

- Invalidation: 1.09551

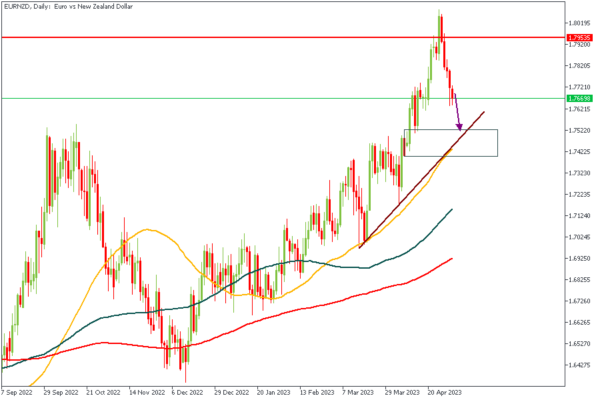

EURNZD – Daily Timeframe

EURNZD had an eventful week at last month’s close; a pin bar rejection candlestick formed inside a supply zone on the weekly timeframe. Because of this, I expect to see a continuation of the bearish rally from the marked supply area with an initial target of 1.75390.

Analysts’ Expectations:

- Direction: Bearish

- Target: 1.75390

- Invalidation: 1.80908

EURCAD – Daily Timeframe

EURCAD is at a key supply zone on the weekly timeframe and has reacted with an initial rejection which closed off last week with a hammer pattern. Therefore, my sentiment is bearish on EURCAD, pending the ECB’s decision, based on the resistance trendline of the consolidation channel, the rally-base-drop supply zone, and the weekly supply zone.

Analysts’ Expectations:

- Direction: Bearish

- Target: 1.48160

- Invalidation: 1.51209

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.