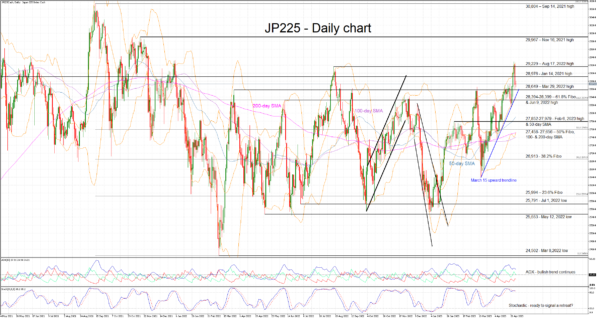

The JP225 cash index is edging higher today, but remains just below the May 1, 2023 print of 29,352, which is the highest traded level since January 5, 2022. The bulls are trying to push the index again towards the recent higher high, but the overall technical picture is less clear at the moment, increasing the possibility of a stronger pullback.

While the Average Directional Movement Index (ADX) is still signaling a strong bullish trend, the stochastic oscillator conveys a more mixed message. It remains inside its overbought (OB) area, where it can stay for an extended period of time, but it appears to be toppy. A potential break below the OB territory will most likely drag the JP225 index considerably lower.

Should this be the case, a retest of both the March 29, 2022 high at 28,649 and the March 15, 2023 upward sloping trendline will come first. The busy 28,394-28,399 area, defined by the 61.8% Fibonacci retracement level of the September 14, 2021 – March 8, 2022 downtrend and the June 9, 2022 high, would then come into play.

If the bulls decide to ignore the mixed technical signs, they will most likely have another go at the crucial 29,229 level provided that they overcome the January 14, 2021 high at 28,976. The path appears to be clear then until the 29,967 level set by the November 16, 2021 high.

To conclude, JP225 index bulls seem to be aiming for another retest of the recent highs, but hasty moves could cause a stronger reaction from the bears and quickly unwind the bulls’ hard-earned gains.