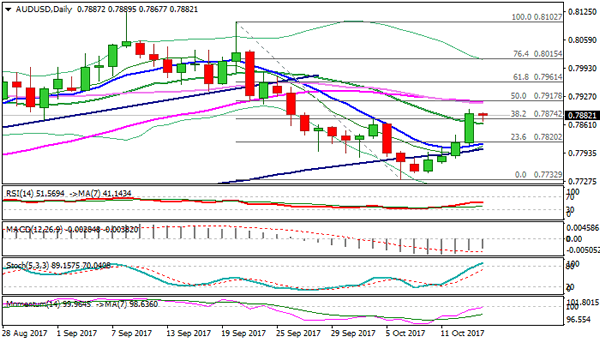

Bulls are pausing on Monday after last week’s strong rally which extended for fourth straight days. The rally peaked at 0.7897 on Friday, with Monday’s easing being triggered by stronger than expected China’s inflation numbers.

The Aussie dipped to 0.7867 in Asia, where 20 SMA offered footstep, with fresh recovery under way.

However, bulls may show stronger signs of stall as studies on daily chart are in mixed mode and slow stochastic entered overbought territory. In addition, converged 30/55SMA’s (0.7911), which formed bear-cross, weigh on near-term action.

Failure to clearly break above 0.7900/11 zone would keep the downside vulnerable.

Loss of 20SMA support would risk test of another strong support at 0.7849 (daily cloud base) and generate stronger bearish signal on break. Bulls require lift above 0.7911 (30/55SMA) and 0.7917 (daily Kijun-sen) to signal bullish continuation and expose daily cloud top at 0.7944. Bullish scenario is supported by Friday’s close above 0.7874 (Fibo 38.2% of 0.8102/0.7732 descend) which now acts as support.

Res: 0.7897, 0.7911, 0.7917, 0.7944

Sup: 0.7874, 0.7863, 0.7849, 0.7817