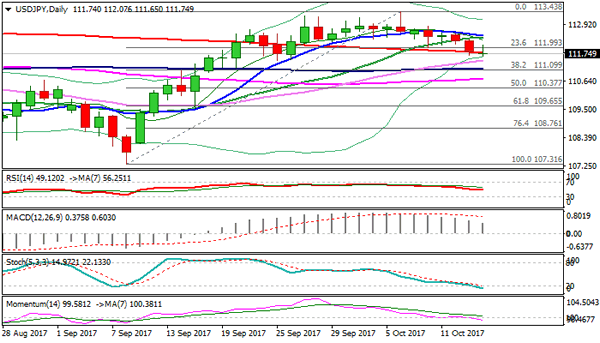

The pair is probing again below key 200SMA support (111.78) following Friday’s spike to 111.68 low but failure to close below.

This marks very significant support and firm break here would trigger further downside and test of plethora of supports which lay below.

Rising 30 SMA (111.46) marks initial support, followed by more significant 100SMA / Fibo 38.2% of 107.31/113.43 rally at 111.10 and top of thick daily cloud at 110.90, break of which would confirm reversal.

Bearish near-term techs are supportive for further easing, but oversold slow stochastic on daily chart warns of further hesitation at 200SMA.

No clear direction could be seen while the latter holds.

At the upside, converging 10/20SMA’s (112.44/35 respectively) marks solid resistance which should keep the upside limited and bias with bears.

Res: 112.07, 112.35, 112.44, 112.56

Sup: 111.65, 111.46, 111.10, 110.90