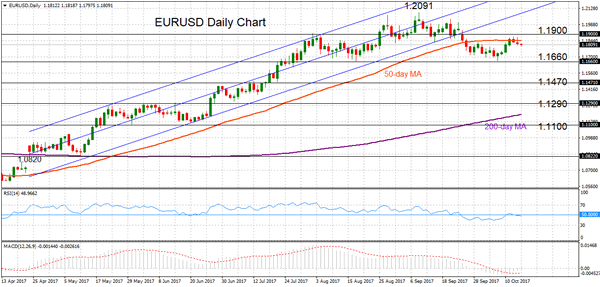

EURUSD is neutral since the end of September after pulling back from 1.2091, the highest level since December 2014. The pair is consolidating below 1.1900 around the 50-day moving average. Near-term risk is tilted to the downside with immediate support at 1.1660.

EURUSD is expected to remain soft. The recent recovery from the 1.1660 area lost steam and the market is now looking capped by the 50-day MA. Further declines would target 1.1470 and 1.1290 ahead of the key 1.1100 level.

Rising back above resistance at the 50-day MA at 1.1842 would see prices move up to the 1.1900 level, which if broken, would increase the odds for another extension towards the 1.2091 peak. From here, there would be a resumption of the uptrend from April, with scope to rise to the 1.25 area.

In the bigger picture, the upward trajectory of EURUSD from the 1.08 area stalled at 1.2091 on September 8. Prices have moved out of the rising channel. Trend strength is weak as indicated by the horizontal 50-day MA, while momentum signals are neutral. However, there is no indication of a trend reversal yet unless the market falls below 1.1400.