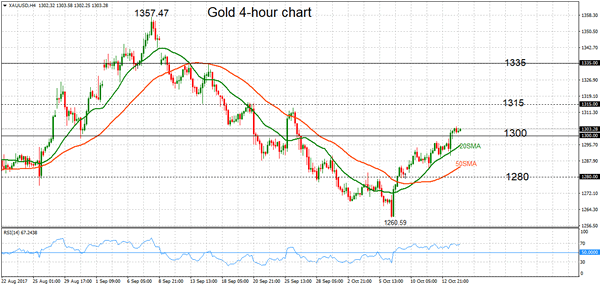

Gold is tracking higher after bouncing from the 1260.5 low and prices have been rising steadily since October 6. There is room for a further extension higher after a bullish signal was given by the crossover of the 20 and 50-period moving averages on the 4-hour chart.

While risk is tilted to the upside, the market may enter a consolidation phase at current levels in the 1300 handle. This is because the RSI indicator has reached overbought levels and is near 70.

Immediate support is now at the key 1300 level. If it holds and there is a push to the upside, prices would target 1315. Building on these gains would help strengthen momentum for a move towards 1335 and then re-test the 1357.47 peak. Clearing this level would allow for a resumption of the broader uptrend.

A drop below the key 1300 support level would dampen the near-term bullish outlook and shift the focus back to the downside. Next targets are at 1280 and 1260.59.