Bitcoin continues its bullish momentum from last week, and after touching a low of $29,138 on April 18, it moved towards a consolidation phase, after which we expect an upward movement to the $30,500-$32,000 range.

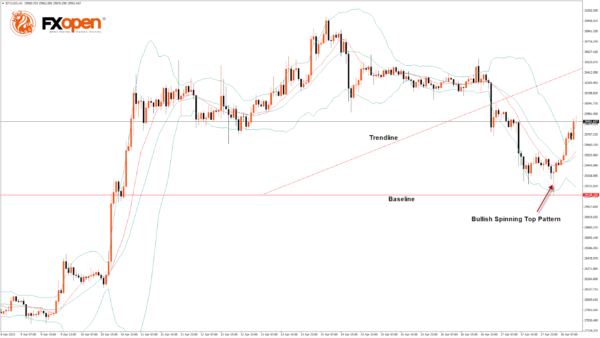

The market opened bullish this week. There is a bullish spinning top pattern above the $29,138 handle on the H1 timeframe.

Bitcoin continues to move up in a mild bullish momentum and is now aiming to cross the $30,000 psychological barrier.

Both the STOCH and STOCHRSI are in overbought zones, meaning that a decline in the price is expected in the immediate short term.

Bitcoin continues to range near a new 1-year high in the weekly timeframe.

The relative strength index is at 63.29, indicating a strong demand for Bitcoin and the continuation of the buying pressure in the markets.

Bitcoin is now moving above the 100-hour exponential and 200-hour exponential moving averages.

Most of the major technical indicators are bullish; the targets for the immediate short term are $30,500 and $32,000.

The average true range indicates low market volatility with mild bullish momentum.

- Bitcoin bullish continuation is seen above $29,138.

- The RSI remains above 50, indicating a bullish market.

- The price is now trading above its pivot level of $29,926.

- The short-term range is mildly bullish.

- Some major technical indicators signal that the price may move to $30,500 and $31,500 soon.

Bitcoin Bullish Continuation Seen Above $29,138

The price of Bitcoin has failed to cross the resistance barrier of $32,000, as the prices declined below $30,000 and entered into a consolidation zone.

There is a bullish price crossover pattern with 20- and 50-period adaptive moving averages in the 4-hour timeframe.

The Aroon indicator signals a bullish trend in the 2-hour timeframe.

The price is above the Ichimoku cloud in the 30-minute chart, indicating a bullish trend.

A support zone is at $28,782, which is a 50% retracement from a 4-week High/Low, and at $29,050, which is a 14-3 daily raw stochastic at 50%.

BTCUSD is now facing its classic resistance level of $30,066 and Fibonacci resistance level of $30,224, breaking above which the price will be able to move to $30,500.

There is an increase of 12.04% in the daily trading volume, which is normal. The short-term outlook for Bitcoin is bullish, the medium-term outlook has turned bullish, and the long-term outlook remains neutral under present market conditions.

The Week Ahead

We can see that Bitcoin continues to bounce from its lows which suggests that the long-term uptrend remains intact, with the current support at $27,645, which is a 14-day RSI at 50.

The price continues to range near the horizontal support in daily and weekly timeframes, indicating bullish sentiment.

We can see the formation of the bullish Harami pattern in the daily timeframe.

The immediate expected target is $31,000, after which we may see some consolidation in the zone of the $30,500 level.

Daily RSI is at 64.68, which indicates the continuation of the bullish trend and the formation of strong bullish demand for Bitcoin in the medium-term range.

We can see the formation of a bullish trend line from $29,138 to $30,456.

The BTCUSD is now facing resistance at $30,970, which is a 13-week high, and at $31,087, which is the second resistance level of the pivot point indicator.