The dollar index edges lower on Tuesday, following a brief recovery in past few sessions, as markets return to business after Easter break.

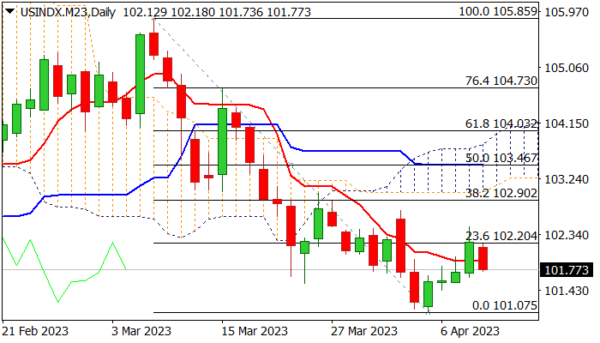

Bounce from new multi-week low at 101.07 (Apr 5) stalled at initial Fibo barrier at 102.20 (23.6% of 105.85/101.07 fall) , with today’s drop generating an initial signal of bull-trap.

Near-term action returned below daily Tenkan-sen (101.90) with daily close below, to increase pressure, as technical studies on daily chart remain in bearish setup (MA’s/negative momentum).

Markets turn focus on the US inflation report (due tomorrow) which will give more clues about Fed’s next steps and subsequently impact dollar’s performance.

Inflation in the US is expected to ease to 5.2% y/y in March from 6.0% in February, but core inflation, which excludes volatile components and is closely watched by the central bank, is forecasted at 5.6% in March vs 5.5% previous month.

Core CPI in line or above expectations would add to concerns that inflation is entrenched and more difficult to be curbed, which will contribute to current about 70% chance of 25 basis points hike on Fed’s May 3 policy meeting and offer fresh support to the greenback.

Conversely, the dollar could weaken if core CPI falls below expectations.

Initial supports lay at 101.50 zone, ahead of 101.07 pivot and more significant 100.66/00 (2023 low/psychological, while 102.20/46 (cracked Fibo 23.6%/Monday’s high) mark pivotal barriers, which guard 102.90/103.14 (Fibo 38.2%/daily Ichimoku cloud base).

Res: 102.20; 102.46; 102.90; 103.14.

Sup: 101.50; 101.00; 100.66; 100.00.