The Kiwi dollar rose around 80 pips in early Wednesday, after the Reserve Bank of New Zealand, in its policy meeting today, surprised markets by increasing its official cash rate by 50 basis points, against widely expected 25 basis points raise.

The latest decision pushed the interest rate to 5.25%, the highest in over 14-years, as the central bank raised rates by 500 basis points in total since October 2021.

RBNZ’s argued its hawkish stance by the fact that inflation is still too high and persistent that leaves the door open for further hikes, on their way to put inflation under control and push it towards central bank’s 1-3% target.

Economists expect the RBNZ to push towards estimated 5.5% terminal rate, which would be an initial signal of an end of tightening cycle, based on the central bank’s expectations that inflation, which hit 7.2% in the fourth quarter, will start to ease after recent drastic increase in borrowing cost starts to show stronger results.

However, the central bank will remain ready to act more if inflationary pressures persist, as upside risks are still high.

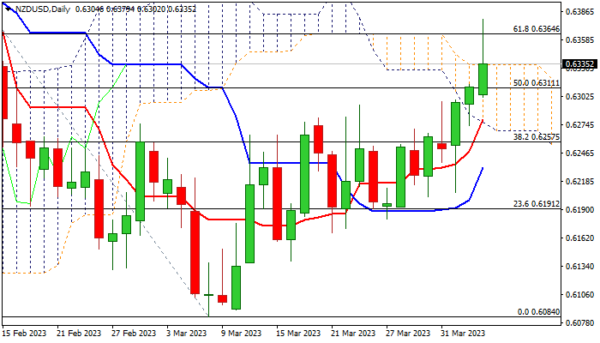

The NZDUSD pair jumped to a seven week high after the RBNZ’s decision and pressure pivotal barriers at 0.6390 (Feb 9/14 double top) after the rally emerged above falling and thickening daily Ichimoku cloud (cloud top lays at 0.6334) and also probed above Fibo resistance at 0.6364 (61.8% of 0.6538/0.6084).

Bulls faced headwinds on approach to 0.6390 target, where strong offers are seen, though remain in play, underpinned by bullish daily studies.

Consolidation should ideally stay above daily cloud top, with deeper dips to be contained at 0.6300 zone (broken Fibo 50% / 100DMA) to keep bulls in play for attack at 0.6390 pivot and possible acceleration higher on break.

Caution on loss of 0.6300 zone handle, which would risk violation of lower pivots at 0.6277/68 (daily Tenkan-sen / daily cloud base.

Res: 0.6346; 0.6379; 0.6390; 0.6430.

Sup: 0.6311; 0.6297; 0.6268; 0.6257.