The Dollar Index was steady in early Monday’s trading, following strong advance last Thu/Fri, sparked by fresh fears about crisis in banking sector, which sent bank shares sharply lower on Friday.

Investors remain concerned despite immediate action by authorities to contain the crisis and assurance that the US banking system was stable.

Growing fears lifted safe-haven dollar and so far offsetting negative impact from Fed’s policy decision last week, which markets saw as dovish.

The US central bank raised interest rates by 0.25% but comments from Chair Powell showed more cautious stance as policymakers try to balance the need for further raising of interest rates due to stubbornly high inflation and threats that this may significantly hurt the economy, exposed to increased stress on banking sector.

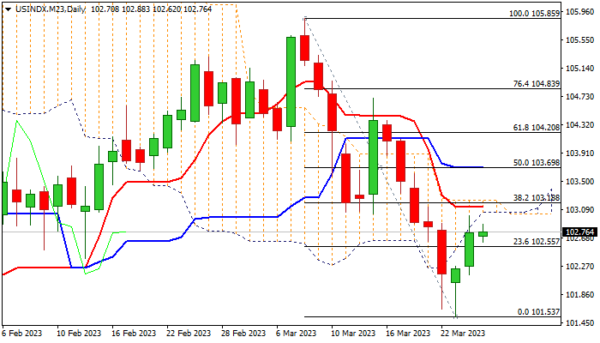

Daily technical studies on daily chart show prevailing bearish tone, as negative momentum continues to strengthen and moving averages are still in bearish configuration, though Tuesday’s daily Ichimoku cloud twist continues to attract near-term bulls, with last week’s long-tailed candle and weekly bear-trap under Fibo support at 102.64, generating initial positive signals.

Fresh bulls need to hold above cracked Fibo pivot at 102.55 (23.6% retracement of 105.85/101.53 bear-leg) to keep near-term bulls intact for attack at key 103.12/12 barriers (daily Tenkan-sen / Fibo 38.2% retracement), violation of which would firm the structure for further advance.

Res: 103.12; 103.18; 103.70; 104.20.

Sup: 102.55; 102.14; 101.88; 101.53.