The Swiss National Bank (SNB) will announce its quarterly monetary policy decision on Thursday (08:30 GMT), but the meeting has already been overshadowed by the Credit Suisse saga. The SNB is hoping that the emergency takeover of Credit Suisse by UBS will be enough to prevent a wider fallout, allowing it to go ahead with its planned rate increase. But there is uncertainty not only about the size of the expected hike but also about how much additional tightening policymakers will signal. As for the Swissie, its safe-haven status hasn’t been able to cushion it from domestic banking woes.

The fall of another giant

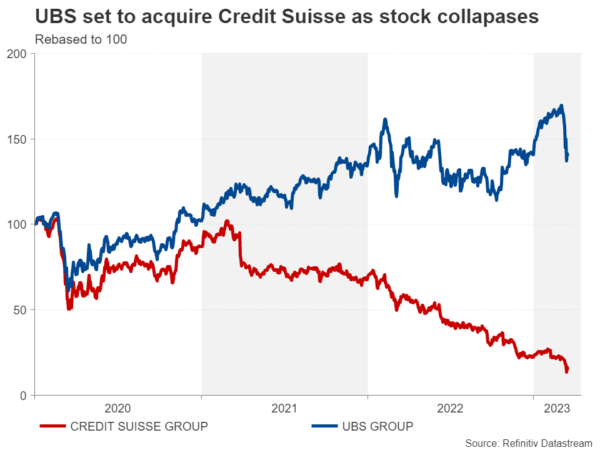

It was only a week ago that SNB Chairman Thomas Jordan was stressing the need to get inflation back into the “area of price stability”, describing it “too high”. Three days later, the share price of the country’s second largest banking group collapsed after its biggest shareholder refused to shore it up with more cash. The selloff came just as the panic over the health of US banks had started to recede, sending fresh shivers through the markets.

Although the troubles facing Credit Suisse are unrelated to those inflicting regional banks in the US, the market reaction highlights how quickly contagion can spread and that policymakers and regulators shouldn’t underestimate the risk posed by the further loss of confidence in financial institutions. It is hard to ignore that the confidence crisis hitting Credit Suisse is reminiscent of the days of the Eurozone debt crisis.

Mega deal fails to calm jitters

And just as they did back then, central banks and governments are riding to the rescue of these too large to fail banks. After the SNB’s decision to grant a CHF 50 billion lifeline to Credit Suisse only temporarily soothed nerves, the forced combination with its bigger rival UBS Group was thought to be the only viable option to save the bank.

The deal is backed by CHF 9 billion in guarantees from the Swiss government and a CHF 100 billion in liquidity by the SNB. Yet, doubts persist about the Swiss and global banking system, adding pressure on SNB policymakers to provide further assurances on Thursday that they stand ready to act should more banks or financial markets in general come under stress.

The stakes are high at upcoming meeting

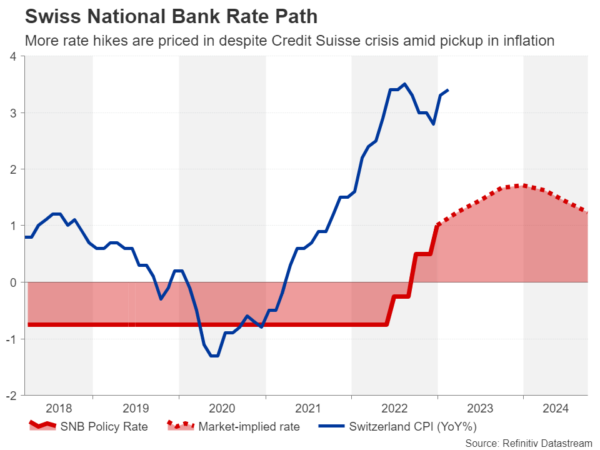

One such reassurance could be to tone down the hawkish rhetoric, placing as much emphasis on the need for financial stability as on achieving low inflation. Prior to the turmoil, a 50-basis-point-rate hike was fully priced in for March, but investors now see a 25-bps increase as more likely. More importantly, even after the dramatic re-evaluation of rate hike expectations, almost two additional rate hikes of 25 bps are priced in for the SNB.

At 3.4% as per the February data, inflation in Switzerland remains comparatively low, hence, it can be argued that the SNB is in a more enviable position and can afford to ease up on its tightening plans. However, the consumer price index has been unexpectedly edging higher since January, rising well above the central bank’s target range of 0-2%, suggesting that it may not have quite peaked just yet.

Will the SNB maintain a hawkish bias?

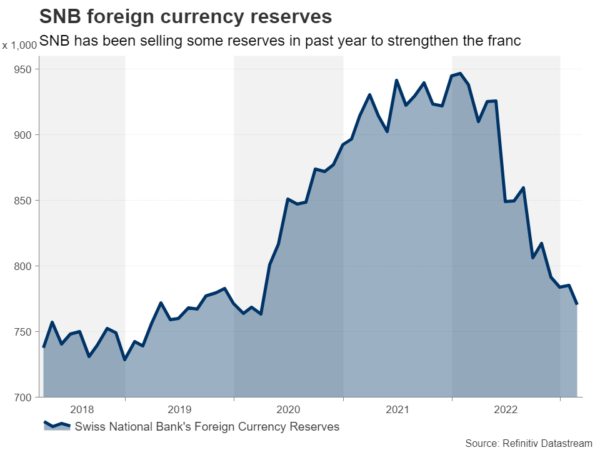

It is worth pointing out the policy rate is not the only tool that the SNB has been using in its fight against inflation as it has also been selling its foreign currency reserve to purchase Swiss francs in an attempt to bring down import prices. This would have been unthinkable a year ago when policymakers considered the franc to be significantly overvalued and were still actively selling it.

But the shift goes to show just how big the hawkish pivot has been in such a short period of time and so the SNB may not necessarily follow in the footsteps of the European Central Bank, which raised rates at its March meeting but indicated that future rate increases will be conditional on the incoming data.

Tougher times ahead for the franc?

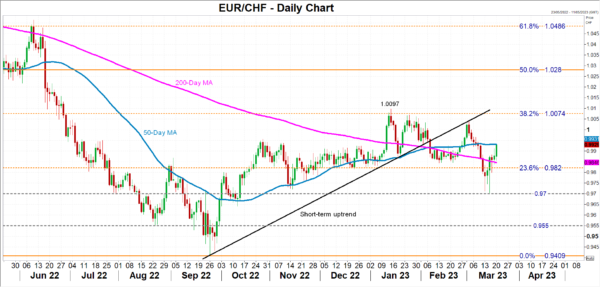

The Swiss franc could come under pressure from a dovish hike, pushing euro/franc above its 50-day moving average, which currently stands at 0.9930. Further gains would bring into scope the January high of 1.0097 that sits slightly above the 38.2% Fibonacci retracement of the March 2021-September 2022 downtrend.

However, if the SNB maintains a hawkish bias, flagging further rate increases, euro/franc could head back towards the 0.97 level, which it came close to breaching last week. A drop below it could spur the franc to rally until the 0.9550 mark.

In the bigger picture, the franc has been mostly neutral against the euro this year. The question now is, would the SNB reinforcing its commitment to additional tightening while the ECB goes on pause work in the Swissie’s favour, or are there more losses to come amid concerns about the country’s banks?