As we await the publication of the Nonfarm payrolls on the 3rd of March, the technical side of things does not seem to favor the US Dollar. Let’s see how the Dollar looks up from the technical side of things.

US Dollar

On the Daily timeframe, the US Dollar can be seen approaching a rally-base-drop supply zone. The 88% of the Fibonacci retracement and the 100-Day moving average serve as additional confluences for the bearish sentiment. Should this be the case, we can expect bullish price action from the XXX-USD pairs.

EURUSD

EURUSD, on the Daily timeframe, is approaching a drop-base-rally demand zone from the previous break above the marked high. The demand zone falls within 88% of the Fibonacci retracement, and we can also see trendline support just within reach of the current price action. On this note, my sentiment here is bullish.

- Analysts’ Expectations:

- Direction: Bullish

- Target: 1.07230

- Invalidation: 1.04550

GBPUSD

Similar to the price action on EURUSD, GBPUSD is also approaching a demand zone, where is also trendline support. In this case, however, the added confluence of the 100 and 200-day moving averages exists.

- Analysts’ Expectations:

- Direction: Bullish

- Target: 1.2300

- Invalidation: 1.1800

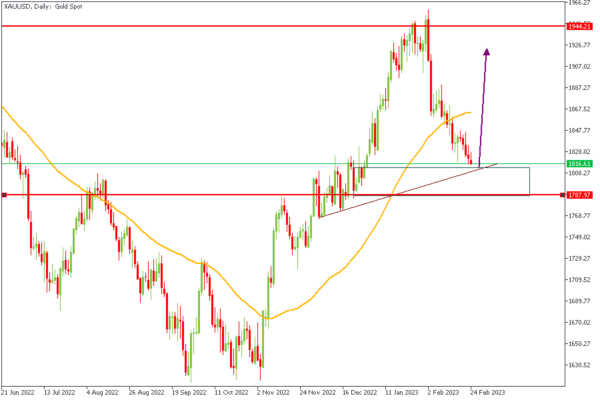

XAUUSD

Gold has presented us with a similar scenario as we have already discussed. Similar confluences and sentiments as well.

- Analysts’ Expectations:

- Direction: Bullish

- Target: $1910

- Invalidation: $1787

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.