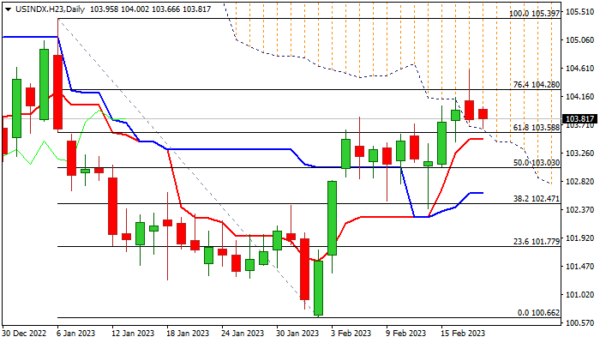

Friday’s close in red with long upper shadow of daily candle and formation of bull-trap above Fibo 76.4% of 105.39/100.66 / top of weekly cloud, signals that bulls might be losing traction.

The price action is so far holding within daily cloud, with cloud base marking strong supports at 103.50 zone, along with broken Fibo 61.8% and daily Tenkan-sen.

Immediate bias is expected to remain with bulls while these supports hold, though initial signals of stall and possible pullback are developing.

Daily Tenkan-sen / Kijun-sen turned sideways, while stochastic is heading south after forming a bearish divergence, though negative signals were so far countered by daily MA’s on bullish configuration and still strong positive momentum.

Expect stronger direction signals on break of either side barriers, with 103.50/00 marking lower pivots (loss of which would weaken near-term structure and risk deeper pullback), while sustained lift above 104.60 (Friday’s spike high / weekly cloud top) would bring bulls fully in play for fresh acceleration higher.

With Monday’s action expected to be quiet due to US holidays, traders turn focus towards economic releases due later this week (US Housing data, GDP, weekly jobless claims, PCE).

Res: 104.28; 104.60; 105.04; 105.39.

Sup: 103.50; 103.03; 102.68; 102.47.