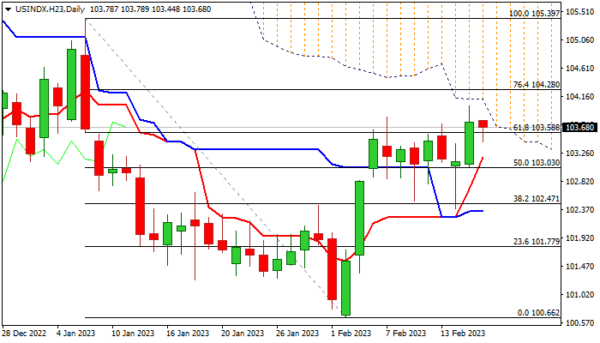

The US dollar edged lower in European trading on Thursday, reversing a part of Wednesday’s 0.65% advance, which tested the upper boundary of the near-term range and approached strong barrier provided by the base of falling thick daily cloud.

The dollar was boosted by renewed expectations that the US central bank would stay in prolonged tightening cycle after inflation unexpectedly rose in January, bur sharp rebound in the US retail sales partially offset bullish impact and contributed to fresh risk sentiment on growing signs of fading recession threats.

Daily studies show that bullish momentum is easing, adding to pressure from a massive daily cloud and suggesting that the greenback’s price may remain in extended sideways mode, on failure to penetrate the cloud.

Bullish bias is expected to remain intact while the price stays above rising daily Tenkan-sen (103.19), while break here would push the price into the lower part of the range and weaken bullish structure.

Caution on loss of pivotal supports at 102.37/33 (range low / daily Kijun-sen) which would signal that corrective phase from 100.66 (Feb 2 low) is likely over.

Res: 103.43; 103.83; 104.14; 104.28.

Sup: 103.44; 103.19; 102.85; 102.33.