Key Highlights

- USD/CAD extended losses below the 1.3450 support.

- A major bearish trend line is forming with resistance near 1.3445 on the 4-hours chart.

- EUR/USD is eyeing more gains above the 1.0900 resistance zone.

- The BoC interest rate decision is scheduled today (forecast 4.5%, versus 4.25% previous).

USD/CAD Technical Analysis

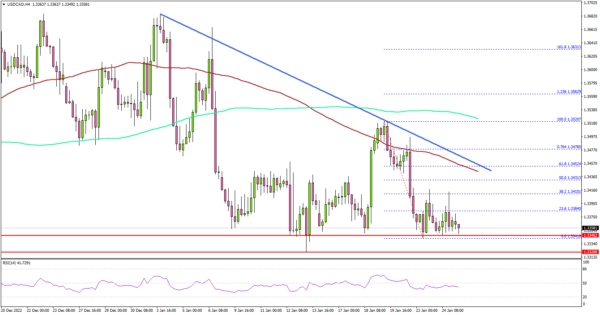

The US Dollar started a fresh decline from well above 1.3550 against the Canadian Dollar. USD/CAD declined below 1.3450 to move into a short-term bearish zone.

Looking at the 4-hours chart, the pair settled below the 1.3450 level, the 100 simple moving average (red, 4-hours) and the 200 simple moving average (green, 4-hours).

The pair even traded below the 1.3400 level and tested the 1.3350 support zone. It is now consolidating losses above the 1.3350 support. On the upside, an initial resistance is near the 1.3420 level.

The next major resistance may perhaps be near 1.3450. There is also a major bearish trend line forming with resistance near 1.3445 on the same chart. A clear move above the 1.3450 resistance might start a steady increase towards the 1.3520 resistance zone.

Any more gains could open the doors for a move towards the 1.3600 level. The next key hurdle is near 1.3640, above which the pair could climb towards the 1.3800 resistance zone.

On the downside, there is a major support at 1.3350. The next major support is near the 1.3320 level. A downside break below the 1.3320 zone might push the pair lower.

The next major support sits near the 1.3250 level. Any more losses might open the doors for a move towards the 1.3120 support zone.

Looking at EUR/USD, the pair is consolidating in a tight range and might attempt a fresh increase above the 1.0900 resistance.

Economic Releases

- German IFO Business Climate Index for Jan 2022 – Forecast 90.2, versus 88.6 previous.

- BoC Interest Rate Decision – Forecast 4.5%, versus 4.25% previous.