The currency pair decreased today and looks determined to start a minor corrective phase on the short term. Price has found strong resistance and now is expected to drop on the short term again. The Yen could increase only if the Nikkei stock index will slip lower on the short term.

The JP225 increased in the morning and tries to recover after the Friday’s drop, a failure to close above the 20756 will confirm a minor drop and a Yen’s appreciation. The perspective is bullish on the JP225 despite a minor drop. The index seems like is losing the bullish momentum, but we can’t talk about another drop at this moment because we don’t have any bearish signal.

A further Nikkei’s increase will force the Yen to depreciate further versus all its rivals, technically, the index could develop a Rising Wedge pattern, but is premature to talk about this.

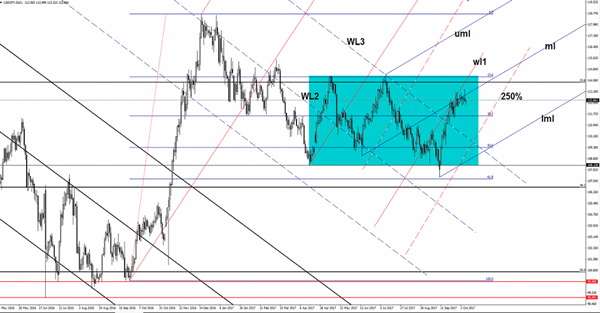

Price has made another false breakout above the median line (ml) of the minor ascending pitchfork, so a minor drop is favored. USD/JPY increased a little in the last hours, but it should drop towards the 38.2% retracement level in the upcoming days.

We had several false breakouts above the median line, signaling an exhaustion, support can be found at the 250% Fibonacci line as well. Technically, its should be attracted by the lower median line (lml) of the ascending pitchfork after the failure to close above the median line (ml).