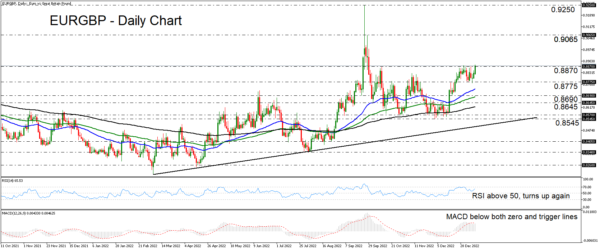

EURGBP rebounded this week, after it found support near the 0.8775 barrier, marked by the low of January 4. Currently, the bulls are trying to emerge above the key resistance zone of 0.8870, the break of which could carry larger bullish implications. In the bigger picture, the pair is trading above all three of the plotted moving averages and well above the uptrend line drawn from the low of March 7, technical signs of a positive medium-term outlook.

The RSI, already above 50, has turned up again, while the MACD, although below its trigger line, is lying well above zero and shows signs it could cross back above its trigger line soon. Both indicators detect upside momentum and corroborate the case for some further near-term advances.

A clear and decisive break above 0.8870 would confirm a higher high and may set the stage for extensions all the way up to the peak of September 28 at 0.9065. If the bulls are not willing to abandon the action there, they may decide to continue climbing higher, perhaps aiming for the high of September 26 at 0.9250.

On the downside, a break below 0.8775 could signal the beginning of a decent correction, perhaps towards the 0.8690 or 0.8645 territory. However, as long as EURGBP trades above the uptrend line drawn from the low of March 7, the bigger picture might still be positive. The move signaling that the bears have stolen the bulls’ swords may be a clear dip below the crossroads of that uptrend line and the 0.8545 barrier, marked by the low of December 1.

To sum up, EURGBP is trading well above a medium-term uptrend line and is now trying to emerge above 0.8870. A decisive move higher would confirm a higher high and may see scope for larger bullish extensions.